Burning Opportunities – Cremation Businesses on the Market

Why Cremation Businesses Represent America's Hottest Death Care Investment

Cremation demand has rocketed past 60 % of all U.S. dispositions, and surveys show nine-in-ten millennials already prefer it to burial. That irreversible shift has turned every credible cremation business for sale into a recession-proof cash-flow play. Typical deals span:

• Annual revenue: $225 K–$6 M+

• Profit margins: 10-15 % (often higher with merchandise)

• Asking prices: $495 K pet operations → $5 M trademark portfolios

Families choose cremation for two simple reasons: it costs $500–$1,000 versus $5,000+ for burial, and it fits modern lifestyles. Yet buyers must weigh strict regulation, six-figure equipment costs, and fast-moving digital competitors before pulling the trigger.

American Mortuary Coolers has supplied custom refrigeration to funeral homes in Tennessee, Georgia, Illinois, South Carolina, Texas, California, New York, and Pennsylvania. We’ve seen what separates thriving operations from money pits, and this guide distills that insight for would-be buyers.

What You'll Learn

• Smart ways to value a cremation business

• Hidden costs (permits, retorts, refrigeration) you’ll inherit

• Top growth levers after closing

• Common deal-killing pitfalls—and how to dodge them

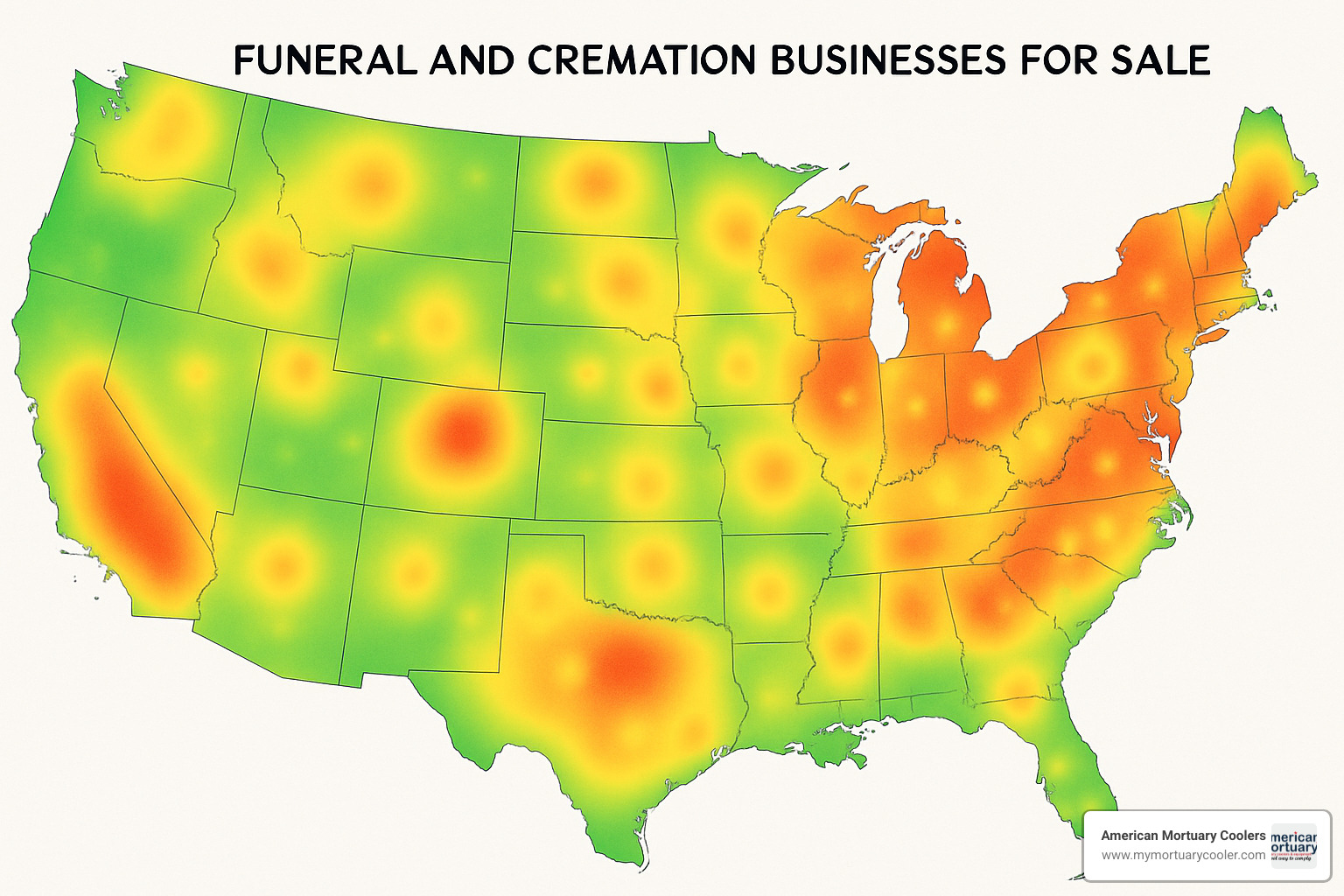

• Where today’s most attractive opportunities live

The 2024 Cremation Market Snapshot & Why Owners Sell

The math is undeniable: deaths in the United States are projected to climb from 2.8 M today to 3.6 M by 2037, while cremation already claims a 60 % market share. Add in burial costs five times higher than cremation, and demand looks bullet-proof for decades.

Western states such as Nevada and Washington exceed 75 % cremation. Traditional regions in the South still lean burial—but even there, younger families choose flame over earth. Online-only providers (see Just Cremation) accelerated this mind-set during COVID, making click-to-arrange cremation the norm.

Corporate roll-ups and private equity are driving an acquisition frenzy. Aging independent owners, exhausted by night-calls and paperwork, often prefer a clean exit to funding new retorts or fighting ever-tightening environmental rules.

Demand Drivers & Growth Forecast

- Boomer mortality surge keeps call volume rising through 2040.

- Eco-awareness—cremation (and water cremation) beats land-use and chemical worries.

- Direct cremation strips cost and formality, boosting margins for lean operators.

- Digital convenience brings families that might never visit a funeral home.

Seller Motivations & Timing

• Succession gaps – kids choose other careers.

• Regulatory fatigue – EPA, OSHA, and state inspectors never sleep.

• Cap-ex cliff – retorts and coolers past end-of-life push owners to sell.

• 24/7 burnout – phones ring at 2 a.m., every holiday, forever.

Roundup of Cremation Business for Sale Opportunities

Below is a snapshot of real listings that illustrate the range—you can find one that fits nearly any budget or ambition.

Midwest "Family Legacy"

• 300 calls/year

• $1.2 M revenue / $350 K SDE

• Real estate included, on-site retort with expansion room

Growth: add pre-need plans and online marketing.

Southeast 19-Location Portfolio

• $6 M+ revenue / $2.7 M SDE

• Multiple crematories, $11 M pre-need backlog

• Ideal for seasoned operators chasing scale.

Purpose-Driven Pet Cremation (St. Louis)

• $495 K ask

• Two staff run everything, individual-only cremations

• Strong vet-clinic referrals; big white-space for regional expansion.

“Celebration Funerals and Cremations®” Brand Package

• Trademark + domain, $5 M OBO

• Start with an instantly protected national name and build locations around it.

Valuation, Financials & Deal Structures for "Cremation Business for Sale" Shoppers

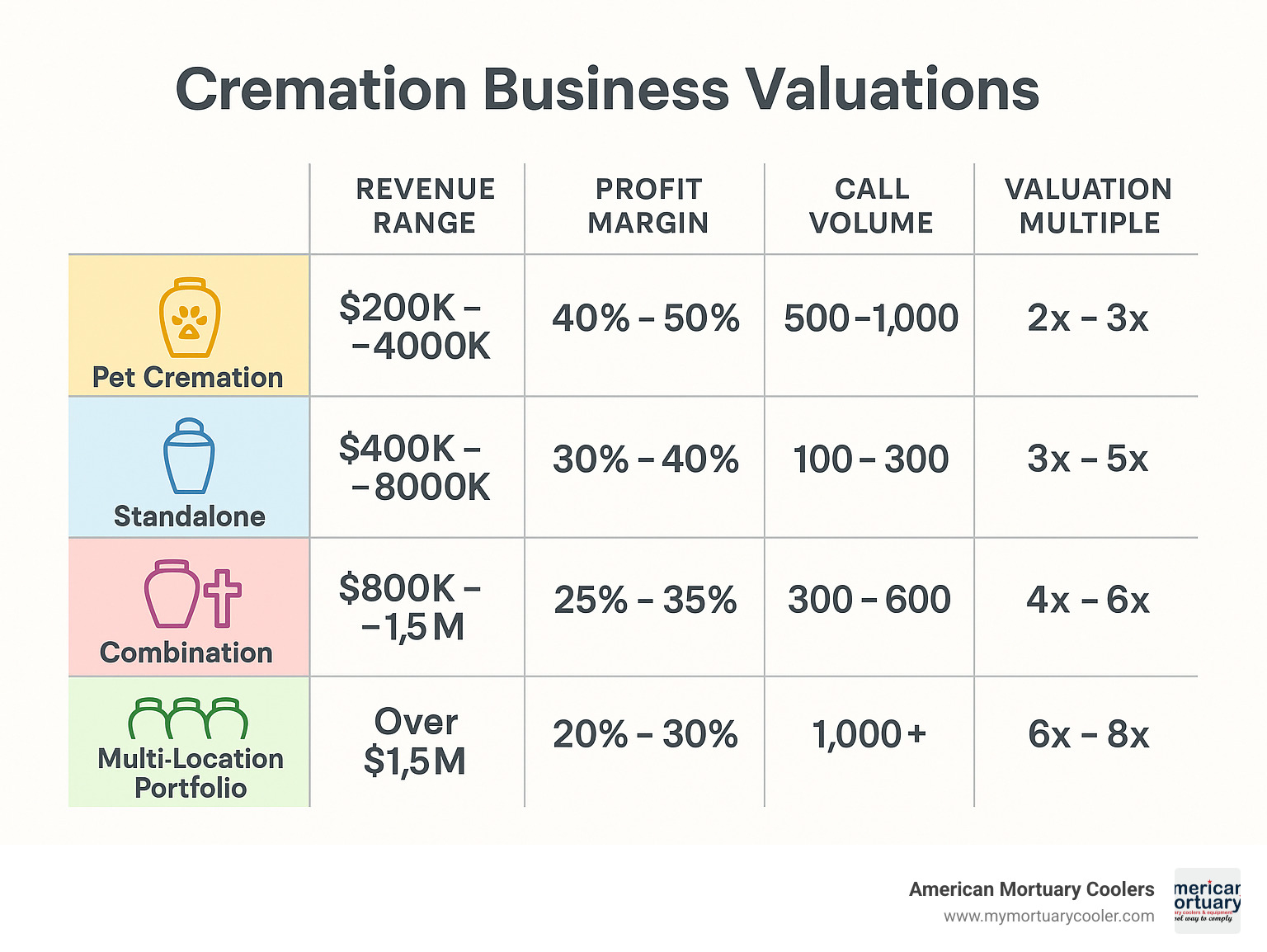

Cremation deals rarely pencil like restaurants or retail. Multiples generally cluster at 4–8× EBITDA or 2–4× SDE for owner-operated shops. Revenue multiples float 0.5–1.5×, rising with on-site retorts and pre-need books.

Key Value Drivers

• Demographics & market share – older, dense populations pay premiums.

• On-site equipment – a retort in-house converts third-party fees into profit.

• Preneed contracts – funded future services steady cash-flow.

• Real estate – owned property kills rent risk.

• Experienced staff – licensing takes months; keeping talent saves downtime.

Typical Deal Terms

Seller financing (10–40 %), earn-outs tied to call volume, and longer escrows (12–18 mo.) allow regulators to sign off and environmental tests to clear. Buyers usually pick asset deals for liability protection, unless keeping hard-won permits demands a stock purchase.

Due Diligence Snapshot

- Verify cremation & air-quality permits transfer.

- Inspect retort logs, maintenance, remaining refractory life.

- Reconcile trust-fund balances with state rules.

- Review 3-5-year financials for volume trends and seasonality.

- Confirm OSHA/EMS, refrigeration capacity (our specialty), and fleet condition.

Risk, Regulation & Compliance Essentials

Buying a cremation business for sale means stepping into one of the most heavily regulated industries in America. The rules are strict, the inspections are frequent, and the penalties for violations can shut you down permanently. But don't let that scare you off - understanding these requirements upfront helps you avoid costly surprises later.

Licensing sits at the heart of everything. Most states require funeral director licenses for key personnel, along with specialized crematory operator certifications. These aren't weekend courses - they involve months of training and continuing education requirements that never end. Business licenses and permits add another layer, and each jurisdiction has its own quirks and timelines.

Environmental regulations can make or break your operation. The EPA doesn't mess around when it comes to emissions monitoring and reporting. You'll need air quality permits, regular testing, and mercury emission controls specifically for dental amalgam in bodies. Waste disposal protocols are equally strict - one mistake can trigger investigations that last months.

OSHA workplace safety standards add another compliance burden. Employee health and safety training, chemical handling procedures, and emergency response protocols all require documentation and regular updates. The 24/7 nature of funeral service means these safety systems need to work around the clock.

The operational side brings its own regulatory maze. Body transportation has specific rules, cremation waiting periods vary by state (Florida requires 48 hours), and record keeping systems must track every detail. One Reddit funeral director summed it up perfectly: "The paperwork never stops, and inspectors show up when you least expect them."

For buyers considering equipment upgrades, our guide on crematory equipment costs and compliance covers the financial impact of staying compliant.

Common Pitfalls & How to Mitigate

Community opposition ranks as the biggest surprise for new owners. Even established crematories face neighborhood pushback when permits come up for renewal. As one experienced owner shared, "Obtaining local permits for cremation furnaces often meets neighborhood objections." Before closing on any cremation business for sale, verify that all permits transfer cleanly and research any pending zoning challenges or community complaints.

Staff certification gaps can shut you down overnight. Crematory operations require certified technicians, and finding replacements isn't like hiring retail workers. When trained staff leave unexpectedly, you might face weeks without proper coverage. Smart owners maintain relationships with certified contractors who can provide backup coverage during transitions.

Equipment maintenance failures hit at the worst possible times. Cremation retorts operate at temperatures exceeding 1,800 degrees Fahrenheit, and specialized components wear out unpredictably. A broken retort during a busy week can force you to outsource cremations, killing your profit margins. Budget generously for preventive maintenance and establish vendor relationships before you need emergency repairs.

Trust fund compliance violations carry devastating penalties. Preneed sales involve complex regulations about how customer payments are held and invested. State regulators audit these accounts regularly, and violations can result in license revocation and criminal charges. Never assume the previous owner handled everything correctly - hire experienced legal counsel to review all trust fund obligations during due diligence.

Pros vs. Cons: Buying Existing vs. Starting New

Choosing between acquiring an existing cremation business for sale versus building from scratch involves weighing speed against control.

Buying existing operations offers immediate cash flow from established customer relationships that took decades to build. You inherit working permits and regulatory approvals that might take years to obtain independently. Trained staff know the systems, and proven market demand reduces uncertainty about profitability timelines.

However, you also inherit every problem the previous owner created. Legacy compliance issues, outdated equipment, and facility limitations come with the territory. Staff and customer transitions don't always go smoothly, and existing brand positioning might not match your vision.

Starting fresh gives you complete control over location selection, facility design, and operational systems. Modern equipment operates more efficiently, and you avoid legacy liabilities that could surface years later. Brand development flexibility lets you position exactly how you want in the market.

But new operations face a brutal timeline to profitability. Permitting processes often take 12-18 months, assuming no community opposition. Staff recruitment and training add months more, while business development costs pile up before the first customer walks through your door. Market acceptance isn't guaranteed, especially in communities with established competitors.

The math usually favors buying existing operations for first-time buyers, while experienced operators might prefer the control that comes with starting fresh.

Post-Acquisition Growth & Diversification

Closing day is the starting line, not the finish. Quick-hit upgrades that move the needle:

• Memorial merchandise – custom urns, jewelry, stones can lift ticket size 30 %.

• Pre-need outreach – schools, churches, VFW posts; future revenue today.

• High-efficiency retorts & coolers – modern units cut fuel and energy bills up to 40 % (see our equipment 101 guide).

• Cloud scheduling/CRM – fewer errors, faster permits, happier families.

Pet & Green Niches

Partner with vets for pet cremation (typical fee $50–$100). Add aquamation or biodegradable urns for eco-minded clients. Both services bolt onto existing workflows without cannibalizing human calls.

Frequently Asked Questions about Buying a Cremation Business

When considering a cremation business for sale, buyers naturally have questions about profitability, costs, and what to expect during the transition. Here are the answers to the most common concerns we hear from potential buyers.

What profit margin can I expect?

Most cremation businesses achieve profit margins between 10-15%, though well-managed operations often exceed these benchmarks. The reality is that profit potential varies significantly based on how you run the business.

Service mix plays a huge role in determining your margins. Direct cremation services typically offer lower margins than full-service options with viewing and ceremony. However, merchandise sales like urns, caskets, and memorial products often carry markups exceeding 50% - this is where many operators boost their bottom line.

Volume matters too. Higher call volumes help spread your fixed costs across more revenue, improving overall profitability. A funeral home serving 300 families annually will have different margin dynamics than one handling 50 calls per year.

Our research across current cremation business for sale listings shows Seller's Discretionary Earnings ranging from $50,000 for smaller operations up to $2.7 million for large multi-location portfolios. Most single-location businesses generate between $200,000 and $600,000 annually in SDE.

The key is understanding that efficiency drives profitability. Modern equipment, streamlined operations, and good staff training all contribute to better margins. That's why equipment condition and operational systems matter so much when evaluating any cremation business opportunity.

How much does a cremation retort cost to replace?

Cremation retort replacement represents one of the largest capital investments you'll face as an owner. While we can't quote specific manufacturer prices, buyers should budget substantial amounts for this essential equipment.

Several factors affect replacement costs. Single-chamber systems cost less than multiple-chamber units, but high-capacity operations need the efficiency of larger systems. High-efficiency models carry premium prices but reduce your ongoing operating expenses through lower fuel consumption.

Installation adds significant cost beyond the equipment itself. Site preparation, utility connections, and compliance modifications can substantially increase your total investment. Modern emissions controls also add complexity and cost compared to older systems.

Equipment age matters when evaluating any cremation business for sale. A facility with a 20-year-old retort will likely need replacement sooner than one with newer equipment. Factor this into your purchase decision and financial planning.

For comprehensive cost analysis and planning guidance, check out our detailed guide on crematory equipment costs.

How long is a typical owner transition period?

Most cremation business for sale transactions include transition support ranging from two weeks to several months, depending on the complexity of the operation. The St. Louis pet cremation business we mentioned earlier offers a two-week training course plus ongoing support - this is fairly typical for smaller operations.

Transition periods serve both buyer and seller interests. You need time to learn the specific systems, meet key staff members, and understand customer relationships. Meanwhile, sellers want to ensure smooth operations continue and their reputation remains intact.

Staff introductions and relationship transfers usually happen first. In the funeral industry, personal relationships drive referrals, so meeting key contacts early helps maintain business continuity. Customer communication about ownership changes requires delicate handling to maintain trust and confidence.

Operational training covers equipment and procedures specific to that location. Every crematory operates slightly differently, and learning the quirks of your particular systems prevents costly mistakes. Vendor relationship transfers ensure you can maintain equipment and supply relationships without interruption.

Regulatory compliance guidance might be the most valuable part of any transition. Understanding local permit requirements, inspection schedules, and compliance deadlines helps you avoid violations that could shut down operations.

Longer transitions generally benefit everyone involved. They give you time to learn without pressure while ensuring customers receive consistent service during the ownership change.

Conclusion

The cremation business for sale market presents a remarkable opportunity for investors who understand that some industries never go out of style. With cremation rates climbing past 60% nationally and showing no signs of slowing down, we're looking at a business model that's both recession-proof and growth-oriented through 2040.

What makes this particularly exciting is the range of entry points available. Whether you're drawn to a $495,000 pet cremation operation that serves grieving pet families with compassion, or you're ready to tackle a multi-million dollar funeral home portfolio with locations across multiple states, there's likely a cremation business for sale that matches your vision and budget.

The numbers tell a compelling story. Profit margins typically run 10-15%, with well-managed operations often exceeding these benchmarks. SDE ranges from $50,000 for smaller operations to over $2.7 million for large portfolios. But beyond the financials, you're entering an industry where your work genuinely matters to families during their most difficult moments.

At American Mortuary Coolers, we've had the privilege of working with funeral professionals across Tennessee, Georgia, Illinois, South Carolina, Texas, California, New York, and Pennsylvania. We've seen how the right equipment and operational setup can make the difference between a struggling business and a thriving one. Our custom refrigeration solutions and nationwide delivery capabilities help ensure your cremation business operates smoothly from the moment you take ownership.

The regulatory landscape might seem daunting at first - and yes, compliance requirements are complex - but remember that these same barriers to entry protect your investment once you're established. Proper due diligence and equipment planning aren't just recommended; they're essential for long-term success.

What excites us most about this industry is how demographic trends strongly support sustained demand growth. The aging baby boomer generation, combined with younger consumers' overwhelming preference for cremation, creates a perfect storm of opportunity that savvy investors are already capitalizing on.

The cremation industry's growth trajectory makes this an ideal time to enter a stable, profitable market that serves an essential community need. Whether you're evaluating your first acquisition or expanding an existing portfolio, success comes down to understanding the fundamentals we've covered in this guide.

For comprehensive guidance on equipment needs and operational requirements, explore our cremation equipment 101 resources designed specifically for funeral industry professionals like you.