Understanding Payment Processing: A Foundation for Modern Commerce

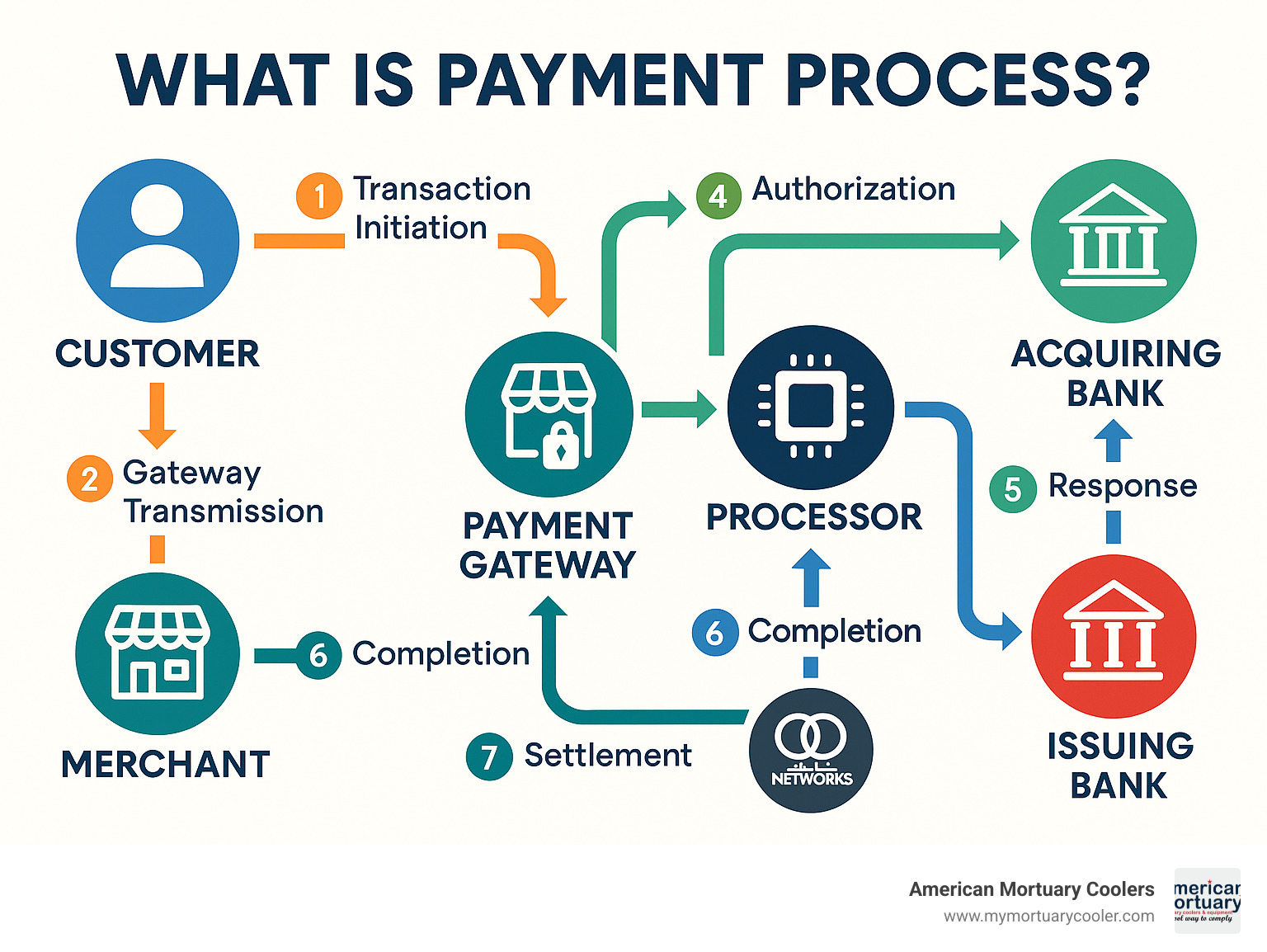

What is payment process? It's the sequence of actions that securely transfer funds from a customer to a business, involving authorization, verification, and settlement through electronic systems. When a customer makes a purchase, the payment process follows these steps:

- Transaction initiation: Customer provides payment details

- Gateway transmission: Data is encrypted and sent securely

- Authorization: Payment processor validates the transaction

- Verification: Issuing bank confirms available funds

- Response: Approval or decline is communicated

- Completion: Merchant finalizes the transaction

- Settlement: Funds are transferred to merchant account

- Reconciliation: Records are updated and verified

The payment process has evolved dramatically, shifting from physical cash to digital methods that now dominate commerce. Digital payments are expected to reach $9.5 trillion in 2023, reflecting their central role in both online and in-person transactions.

For businesses, understanding payment processing isn't just technical knowledge—it's a strategic advantage. Half of customers will abandon an online purchase if payment takes more than ten seconds, making efficient payment processing directly tied to revenue and growth.

I'm Mortuary Cooler, a national supplier of mortuary equipment with extensive experience implementing secure payment processes for funeral service providers. My expertise in what is payment process comes from years of helping funeral homes streamline their procurement operations while maintaining the highest security standards.

Payment Processing 101: Why It Matters for Business Growth

Ever stood in line watching someone fumble with cash or waited as a website spins endlessly during checkout? Those moments can cost businesses dearly. The numbers tell a sobering story: 50% of customers will abandon their online purchases if payment takes longer than ten seconds.

The digital payments landscape has exploded into a $9.5 trillion market in 2023, with 9 out of 10 Americans having made digital payments in the past year. This isn't just a trend—it's a fundamental shift in how we do business.

According to a recent study on checkout speed, even a one-second delay in page loading can reduce conversions by 7%. When you're purchasing essential equipment like mortuary coolers, that delay could mean thousands in lost revenue.

Efficient payment processing delivers real business benefits: improved cash flow with faster settlements, less time on paperwork thanks to automated reconciliation, better security with modern fraud prevention, valuable insights from transaction data, and scalability that grows with your business.

Payment Processing vs. Traditional Cash Handling

While there's something nostalgic about traditional cash handling, digital payment processing has clear advantages. According to Deloitte's 2025 insights, checks are headed toward extinction, while cash usage continues its steady decline.

Traditional cash handling requires manual counting and reconciliation, creates physical security risks, limits payment options, delays access to funds, invites human error, and provides minimal business intelligence.

In contrast, digital payment processing automates tracking, uses encrypted security, offers multiple payment methods, provides faster settlements (typically 1-3 days), ensures accurate records, and delivers rich analytics on purchasing patterns.

Funeral homes that accept modern payment processing consistently report spending 30-40% less time on payment administration, making fewer reconciliation errors, seeing happier customers, and enjoying more predictable cash flow.

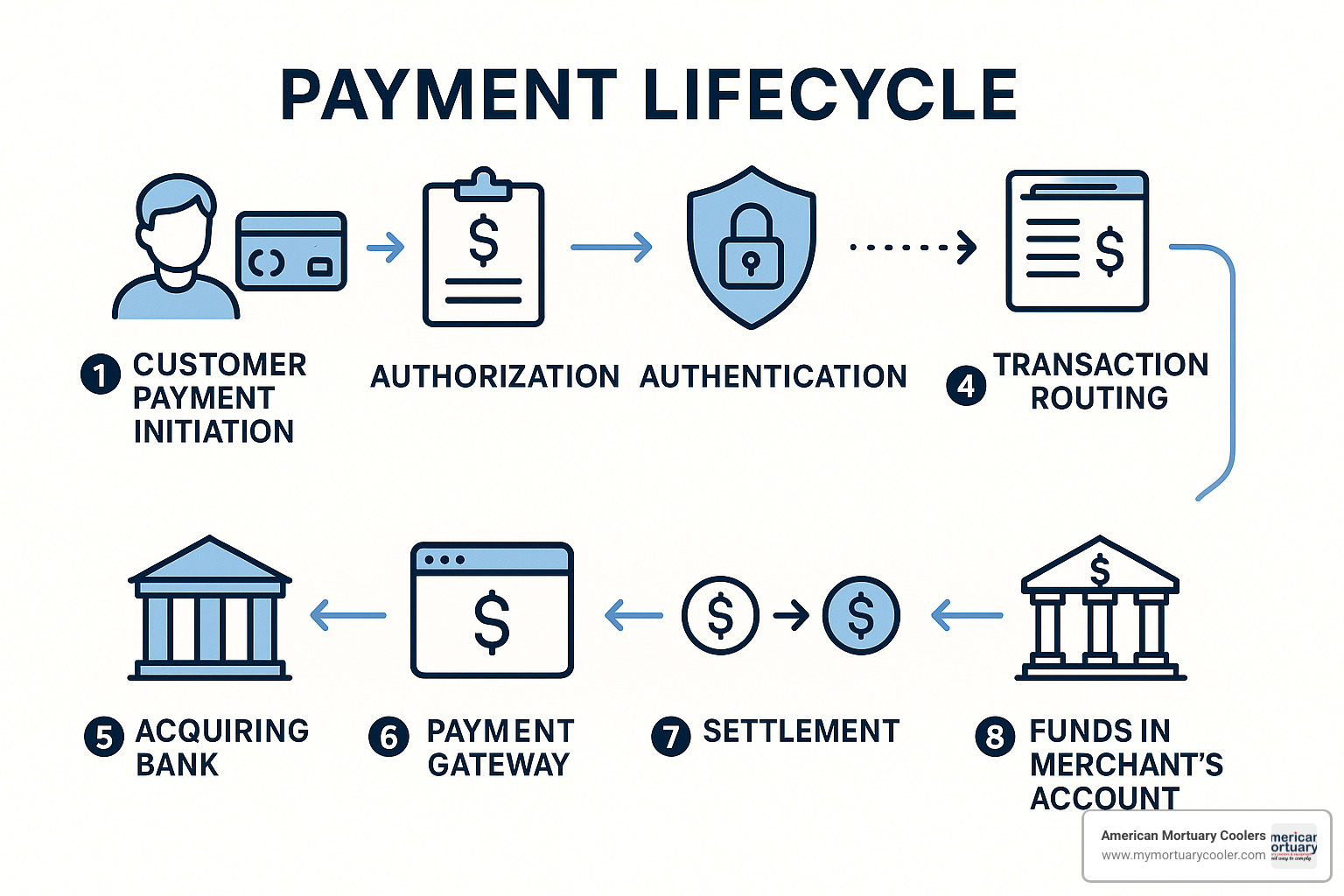

What Is Payment Process? An 8-Step Walkthrough

Ever wonder what happens after you tap your card or click "Pay Now"? Let's pull back the curtain on what is payment process and follow the journey your money takes.

1. Transaction Initiation

It all starts with you, the customer, deciding to buy something. Whether you're swiping a card, tapping your phone, or clicking "Purchase" online, you're kicking off a complex but lightning-fast process.

2. Payment Gateway Transmission

The payment gateway acts as the secure digital doorway your information passes through. It immediately encrypts your card details and sends them safely to the next stop.

3. Transaction Authorization

Your payment info reaches the processor, which routes your details to the right card network (Visa, Mastercard, etc.), runs fraud checks, and formats everything properly before passing it along.

4. Issuing Bank Verification

Your bank now steps in to answer important questions: Is this really your card? Do you have enough money? Is this purchase suspicious?

5. Authorization Response

The answer from your bank races back through the same channels—from your bank to the card network, to the processor, through the gateway, and finally back to the merchant. This entire back-and-forth typically takes just 1-2 seconds.

6. Transaction Completion

With approval in hand, the business can finalize your purchase. At American Mortuary Coolers, this is when we'd complete your order for that custom cooler and prepare your equipment for production.

7. Settlement Process

At the end of the day, all approved transactions get bundled together and sent for processing. The funds begin their journey from your bank, through the card networks, and eventually land in the merchant's account—usually within 1-3 business days.

8. Reconciliation and Reporting

Finally, everyone balances their books. The business matches their sales records against what actually got paid, the processor generates reports, your bank updates your statement, and the merchant's bank confirms the deposit.

For those who want to dive deeper into the technical side, How Are Payments Processed? offers an excellent breakdown of the mechanics.

From Swipe to Settlement: Timeline & Key Data Touchpoints

The authorization happens almost instantly—those 1-2 seconds when you're waiting for the terminal to say "Approved." By the end of the business day, the merchant "captures" all authorized transactions in a batch. The settlement phase typically takes 1-3 business days for the funds to actually land in the merchant's account.

Who's Involved: Key Components & Parties in a Payment Process

The payment process isn't just a simple A-to-B transaction—it's more like a well-choreographed dance with multiple partners working together to securely move funds.

Key Parties in the Payment Ecosystem

The customer initiates everything by deciding to make a purchase, providing payment details and expecting to receive goods or services in return.

The merchant (that's us at American Mortuary Coolers) maintains the systems that accept payment, whether that's our secure website or point-of-sale system.

The payment gateway acts as the digital doorway for your transaction, encrypting your sensitive payment data and ensuring it travels safely.

The payment processor routes transactions between all parties, maintains connections to card networks, and provides reports for tracking sales. You can learn more about the critical role of the payment processor in making transactions happen.

The acquiring bank holds our merchant account, receives funds from card networks, and deposits them into our account.

Card networks like Visa, Mastercard, Amex, and Find set the rules, establish standards, facilitate communication between banks, and step in when disputes arise.

Your issuing bank authorizes or declines your transaction based on your available funds or credit, and extends credit if you're using a credit card.

The point-of-sale (POS) system captures payment information and integrates with the payment gateway, ensuring equipment purchases process smoothly while managing inventory.

Payment Gateway vs. Payment Processor: Clear Differences

Though they work closely together, payment gateways and processors serve distinct functions:

The payment gateway is what you interact with when entering payment information. It encrypts your sensitive data, screens for potential fraud, and tells you whether your purchase was approved or declined.

The payment processor works behind the scenes, routing transactions through financial networks, maintaining relationships with banks and card networks, handling the actual movement of funds, and providing merchants with statements.

Gateways handle tokenization, replacing your card data with secure tokens for future transactions, and apply the first layer of fraud filters. Processors focus on fund movement—the actual settlement of money—while gateways concentrate on secure data transmission.

Payment Methods, Fees & Pricing Models Explained

Understanding payment options and fee structures helps businesses optimize their payment strategy.

Popular Payment Methods

Credit/Debit Cards

- Most widely accepted electronic payment method

- Processing fees: 1.5% to 3.5% plus a fixed fee

- Settlement: 1-3 business days

- Chargeback risk: Medium to high

ACH (Automated Clearing House)

- Direct bank-to-bank transfers

- Lower fees ($0.20 to $1.50 per transaction)

- Settlement: 2-5 business days

- Lower chargeback risk

- Ideal for recurring payments

Digital Wallets

- Apple Pay, Google Pay, Samsung Pay, PayPal

- Similar fees to credit cards

- Increased security through tokenization

- Faster checkout experience

Buy Now, Pay Later (BNPL)

- Affirm, Klarna, Afterpay

- Merchant fees: 2-8% of transaction value

- Increases average order value

- Provider assumes credit risk

Cryptocurrency

- Bitcoin, Ethereum, and others

- Irreversible transactions (no chargebacks)

- Growing acceptance for large purchases

According to recent research, digital payments have now surpassed traditional payment methods in the US.

Understanding Fee Structures

Payment processing fees can significantly impact your bottom line. Here's a comparison of the main pricing models:

| Pricing Model | Structure | Best For | Example Rate | $1,000 Transaction Cost |

|---|---|---|---|---|

| Flat Rate | Simple fixed percentage + fixed fee | Low-volume merchants | 2.9% + $0.30 | $29.30 |

| Interchange Plus | Interchange + markup | Medium to high volume | Interchange + 0.3% + $0.10 | $21.10* |

| Tiered | Qualified, mid-qualified, non-qualified rates | Predictable budgeting | 1.79% (Q) to 3.25% (NQ) | $17.90 - $32.50 |

| Subscription | Monthly fee + per-transaction fee | High volume, high ticket | $99/mo + $0.10/transaction | $0.10 + monthly fee |

*Assumes average interchange rate of 1.8%

Optimising Costs: Negotiation & Method Mix

Smart businesses actively optimize their payment costs through:

1. Volume-Based Discounts

- Consolidate processing with one provider

- Request rate reviews after reaching volume thresholds

2. Strategic Payment Method Mix

- Offer ACH payment options for large equipment purchases

- Incentivize lower-cost payment methods

3. Reduce Risk Factors

- Implement strong fraud prevention to minimize chargebacks

- Process card-present transactions whenever possible

4. Negotiate Beyond Rates

- Request waived PCI compliance fees

- Seek faster settlement options without additional fees

Security, Compliance & Risk Management Essentials

When data breaches make headlines almost weekly, protecting your customers' financial information isn't just good business—it's essential.

Key Security Standards and Requirements

The foundation of payment security is PCI DSS (Payment Card Industry Data Security Standard). Think of it as the security rulebook that every business handling card payments must follow. You can read the complete PCI-DSS for details, but the essentials include building secure networks, protecting cardholder data, testing systems regularly, and maintaining strong access controls.

EMV technology (those chips on credit cards) creates a unique code for each transaction, making it nearly impossible to create counterfeit cards. For businesses accepting in-person payments, having EMV-compliant terminals is required to avoid liability for fraudulent transactions.

Behind the scenes, encryption and tokenization protect payment data. Encryption scrambles data during transmission, while tokenization replaces sensitive card details with non-sensitive substitutes.

For online transactions, 3-D Secure adds an extra layer of protection, redirecting customers to verify their identity with their bank, which reduces fraud for card-not-present transactions.

Managing Risk: Chargebacks and Disputes

Even with strong security, disputes happen. A customer might not recognize a charge, be dissatisfied with a product, or (rarely) be attempting friendly fraud.

Focus on prevention through clear communication and excellent service. When a dispute does arise, you'll typically have 7-10 days to respond with evidence. The issuing bank then makes the final call on whether to uphold or reverse the chargeback.

Building a Bullet-Proof Payment Environment

Creating a truly secure payment ecosystem requires a culture of security within your business.

Staff training is perhaps the most overlooked aspect of payment security. Your team needs to understand proper procedures for handling payment information and what to do if they suspect a security breach.

Regular security audits help identify vulnerabilities before they become problems, including vulnerability scanning (quarterly) and penetration testing (annually).

Real-time monitoring catches suspicious activity as it happens, flagging unusual transaction patterns like a sudden burst of high-value purchases or transactions from unexpected locations.

Finally, smart data retention policies ensure you're not keeping customer data longer than necessary. The less sensitive data you store, the less there is to protect.

Selecting & Optimising Your Payment Processing Solution

Choosing the right payment processor isn't just a technical decision—it's a business partnership that directly impacts your bottom line and customer satisfaction.

Essential Features Checklist

When evaluating payment processors, look for these key features:

Payment method flexibility should be at the top of your list—your customers need options that work for them, whether that's credit cards for smaller purchases or ACH transfers for larger investments.

Pricing transparency is non-negotiable. Look for clear, straightforward pricing structures and detailed monthly statements that don't require a financial degree to decipher.

Settlement speed matters tremendously, especially when managing cash flow. Next-day funding can make the difference between seizing an opportunity and missing it entirely.

Strong reporting and analytics turn transactions into insights about customer behavior and business patterns. The best systems integrate seamlessly with your accounting software, saving hours of reconciliation each month.

Your payment system shouldn't exist in isolation. Integration capabilities with your existing software ecosystem prevents the headache of double-entry and reduces errors.

Finally, consider where your business will be in three years. Will your scalability needs change? The right solution grows with you, eliminating the need for another migration down the road.

For funeral homes planning significant equipment purchases, it's worth exploring More info about smart financing options that complement your payment processing solution.

Migration & Integration Best Practices

Transitioning to a new payment processor can feel overwhelming, but success comes from thorough testing and a gradual approach.

Start with sandbox testing in a controlled environment where mistakes won't impact real customers or your finances. Test every integration point with your existing systems before going live.

Implement a phased roll-out approach. Choose your quietest location or slowest business period to make the switch. Have backup payment methods ready—just in case.

Proper ERP/CRM synchronization means customer payments automatically update their records, invoices mark themselves as paid, and your accounting system stays in perfect balance without manual intervention.

Don't forget about customer communication. Let your customers know about any visible changes to their payment experience, update your invoices with new payment instructions, and make sure your staff can confidently explain the new options.

Frequently Asked Questions About Payment Processing

What is payment process in simple terms?

Think of the payment process as a well-choreographed dance that moves money from your customer's account to your business bank account. While it might seem instantaneous when someone taps their card or clicks "pay now," there's actually quite a bit happening behind the scenes.

In everyday terms, it's the series of steps that securely transfers funds when a purchase happens. Your customer experiences a seamless transaction while sophisticated security measures verify everything is legitimate and proper.

What is payment process for credit-card transactions?

Credit card transactions follow a specific journey with several distinct phases:

When a customer swipes, taps, or enters their card information, the authorization phase begins immediately. Their card details zoom through the payment gateway to their issuing bank, which checks if the card is valid and has sufficient credit available.

Throughout the day, these approved transactions get stored in a batch that's submitted to the processor, usually at day's end. Then during clearing, the processor forwards everything to card networks like Visa or Mastercard.

The real money movement happens during settlement, when the issuing bank transfers funds to the merchant's acquiring bank. Finally, during funding, the merchant receives the net amount after various fees are deducted. This typically takes 1-3 business days.

How can businesses reduce payment processing fees?

Every dollar saved on payment processing goes straight to your bottom line! Here's how to trim those costs:

Mix up your payment methods strategically. For large equipment purchases, encouraging ACH/bank transfers can dramatically cut costs, with fees as low as $0.20-$1.50 per transaction compared to percentage-based credit card fees.

Don't accept the first rate you're offered. The payment processing world is competitive, and rates are more negotiable than most business owners realize. Request interchange-plus pricing for transparency and leverage your processing volume as negotiating power.

Improve your transaction quality to qualify for better rates. Process card-present transactions when possible, implement address verification for online payments, and ensure you're using the proper business category codes.

Minimize risk factors that drive up costs. Strong fraud prevention measures, clear refund policies, and prompt responses to disputes all help maintain a clean processing history.

Conclusion

Remember the last time you stood in a long checkout line, watching the person ahead fumble with cash or struggle with a declined card? That feeling of frustration is exactly what modern payment processing aims to eliminate. Throughout this guide, we've peeled back the layers of what is payment process – revealing it's not just about moving money, but about creating experiences that feel effortless and build trust.

The humble payment has transformed from simple cash exchanges into a digital dance of encryption, authorization, and settlement that happens in seconds rather than days.

For those in the funeral service industry, this evolution matters deeply. When families are making significant purchases during difficult times, the last thing they need is payment friction. Similarly, when funeral directors need to quickly procure essential equipment like mortuary coolers, payment hiccups can delay critical infrastructure.

The choices you make about payment processing have real business consequences. Selecting the right processor, optimizing your payment mix, and negotiating favorable terms can dramatically reduce costs and improve cash flow. I've seen funeral homes save 20-30% on processing fees simply by implementing the strategies we've discussed.

Security isn't just a technical requirement—it's a promise you make to every customer. The trust you build through robust payment security translates directly into business reputation and customer loyalty.

At American Mortuary Coolers, we've made secure, efficient payment processing a cornerstone of how we serve funeral professionals across our nationwide network. From Tennessee to California, we've seen how payment efficiency creates competitive advantage that translates directly to business success.

As you reflect on your own payment processes, I encourage you to look beyond the mechanics and see the bigger picture. The goal isn't just to move money—it's to create moments of simplicity that let your customers focus on what matters.

For more information on how we can help streamline your mortuary equipment procurement with hassle-free payment options, explore More info on our one-stop equipment solutions.

In a world of increasing complexity, sometimes the greatest luxury is simplicity. That's what great payment processing delivers—and why it matters so much to the businesses and customers who experience it.