Understanding the Evolution of Payment Methods

What are payment methods? They are the various ways people and businesses transfer money in exchange for goods and services. Payment methods range from traditional options like cash and checks to digital solutions such as credit cards, mobile wallets, and cryptocurrencies.

For a quick reference, here are the main types of payment methods:

| Payment Method | Description | Best For |

|---|---|---|

| Cash | Physical currency exchange | Small, in-person transactions |

| Checks | Paper documents ordering banks to pay | Record-keeping, B2B payments |

| Credit/Debit Cards | Plastic or digital cards linked to accounts | Online and in-store purchases |

| Bank Transfers | Direct movement of funds between accounts | Large transactions, B2B |

| Digital Wallets | Apps storing payment credentials | Convenient mobile payments |

| Buy Now, Pay Later | Deferred payment options | Splitting costs into installments |

| Contactless | Tap-to-pay via NFC technology | Quick in-store transactions |

| Cryptocurrency | Blockchain-based digital currency | International transfers, privacy |

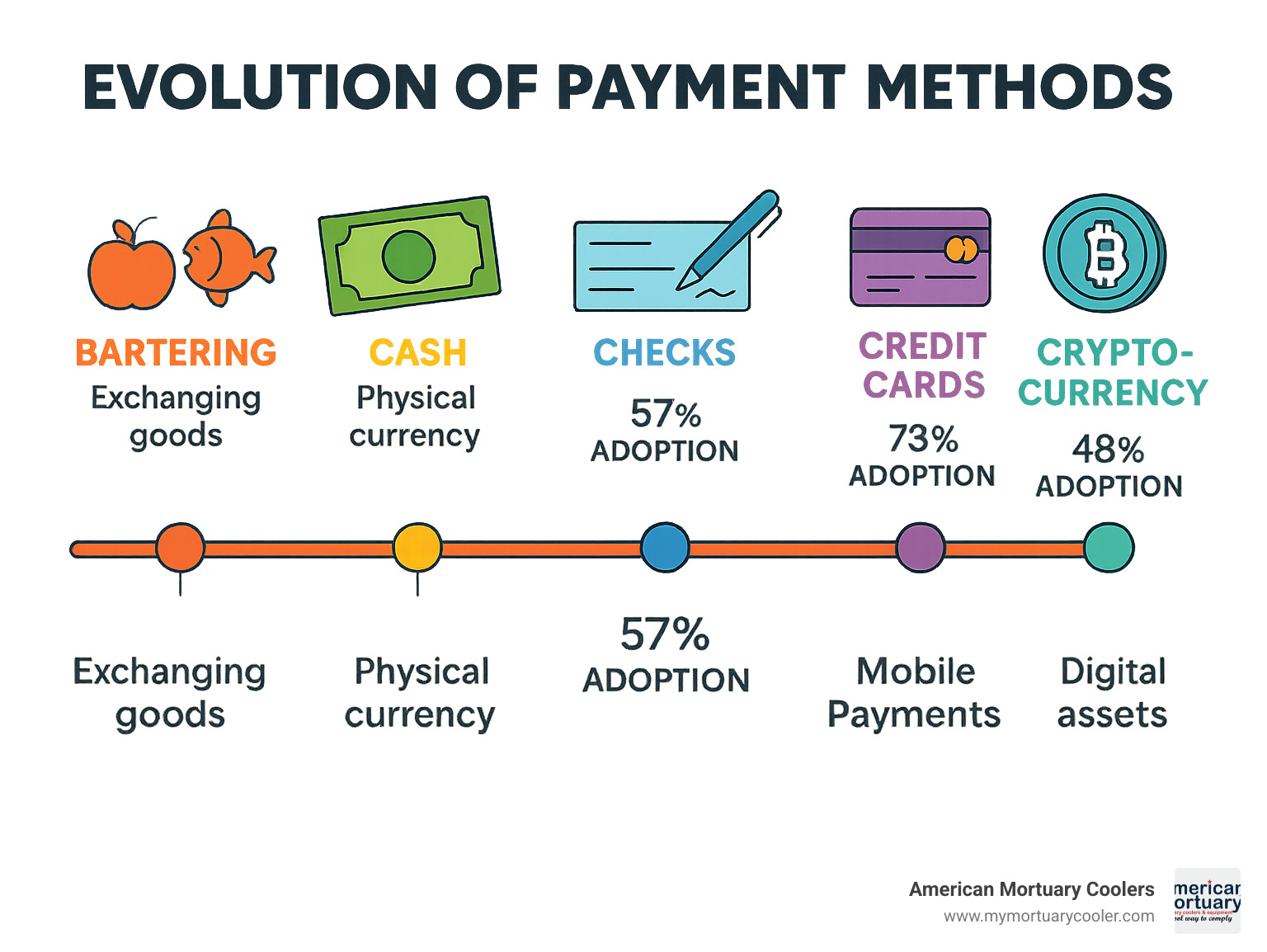

The way we pay has evolved dramatically over time. Just a few decades ago, cash and checks dominated the landscape. Today, nearly half (48%) of UK shoppers prefer contactless payments, while in China, 54% of online transactions involve digital wallets like Alipay or WeChat Pay.

This shift matters for businesses and consumers alike. Studies show up to 13% of shoppers abandon their carts if their preferred payment option isn't available, directly impacting sales and customer satisfaction.

What are payment methods? Definition & Core Concepts

When we talk about what are payment methods, we're discussing the bridges that connect buyers and sellers. These are the various ways money moves from customers to businesses when they purchase products or services.

Payment methods come in several forms. Some are physical things you can hold in your hand, like cash or credit cards. Others exist purely in the digital world, like mobile payments or cryptocurrency. Some settle instantly, while others take days to process completely.

Here's a helpful comparison of the main payment options available today:

| Method Type | Settlement Time | Processing Fees | Chargeback Risk | Global Acceptance |

|---|---|---|---|---|

| Cash | Instant | None | None | Limited by currency |

| Checks | 1-7 days | Low/None | Medium | Low |

| Credit Cards | 1-3 days | 1.5-3.5% | High | High |

| Debit Cards | 1-3 days | 0.5-2% | Medium | High |

| Bank Transfers | 0-3 days | Varies | Low | Medium |

| Digital Wallets | Instant to user | 1-3% | Medium | Growing |

| Cryptocurrency | Minutes to hours | Low/Variable | None | Limited but growing |

When we discuss legal tender, we're talking about the officially recognized currency that must be accepted for debt payment within a country. While cash is legal tender, businesses generally have the freedom to choose which payment methods they'll accept.

Why asking "What are payment methods" matters for businesses

Understanding what are payment methods directly impacts your bottom line. About 13% of shoppers will walk away if they can't use their preferred way to pay—that's potential revenue lost.

Payment options also build trust. When we offer secure, familiar ways to pay, our funeral home customers feel more confident in their purchase of our mortuary coolers.

For businesses looking to expand, payment knowledge is crucial. Different regions have distinct preferences—our customers in Tennessee often have different payment expectations than those in California or New York.

Smart payment management also helps with cash flow. Each method has its own timeline for when the money actually hits your account.

"What are payment methods" for consumers

From the consumer perspective, payment methods matter for several practical reasons:

Budgeting becomes easier with certain payment types. Cash gives immediate feedback—when it's gone, it's gone. Credit cards might delay that reality check.

Speed and convenience drive many payment choices. The surge in contactless payments (up 25% in the UK in just one year) shows how much people value quick transactions.

Not everyone has access to all payment methods. Some folks don't have bank accounts and rely heavily on cash, while others prefer digital wallet technology.

Security concerns often guide payment choices too. Credit cards typically offer stronger fraud protection than debit cards or cash.

Traditional Payment Methods Still Going Strong

Despite our increasingly digital world, traditional payment methods aren't going anywhere just yet. Like that reliable old truck that still gets the job done, these tried-and-true payment options continue to serve important purposes in our economy.

Cash & Coins – timeless yet shrinking

Cash offers some unique advantages that digital alternatives simply can't match:

- Complete anonymity – no digital footprint whatsoever

- Zero transaction fees for merchants

- Universal acceptance without requiring any technology

- Immediate settlement with no waiting for funds to clear

- Effective budgeting tool – 52% of cash users report that physical currency helps them stick to spending limits

However, cash usage is declining rapidly. About 41% of American adults now go through a typical week making zero cash purchases. Projections suggest cash will represent just 8% of global point-of-sale transactions by 2027.

Checks & Money Orders – paper trail under pressure

Checks provide that valuable paper trail that's helpful for accounting and tax documentation. Money orders offer similar benefits but with guaranteed funds.

However, check usage has fallen dramatically – declining by 19% from 2020 to 2021 alone. The delayed settlement time (typically 1-7 business days) and fraud concerns have pushed many toward faster, more secure options.

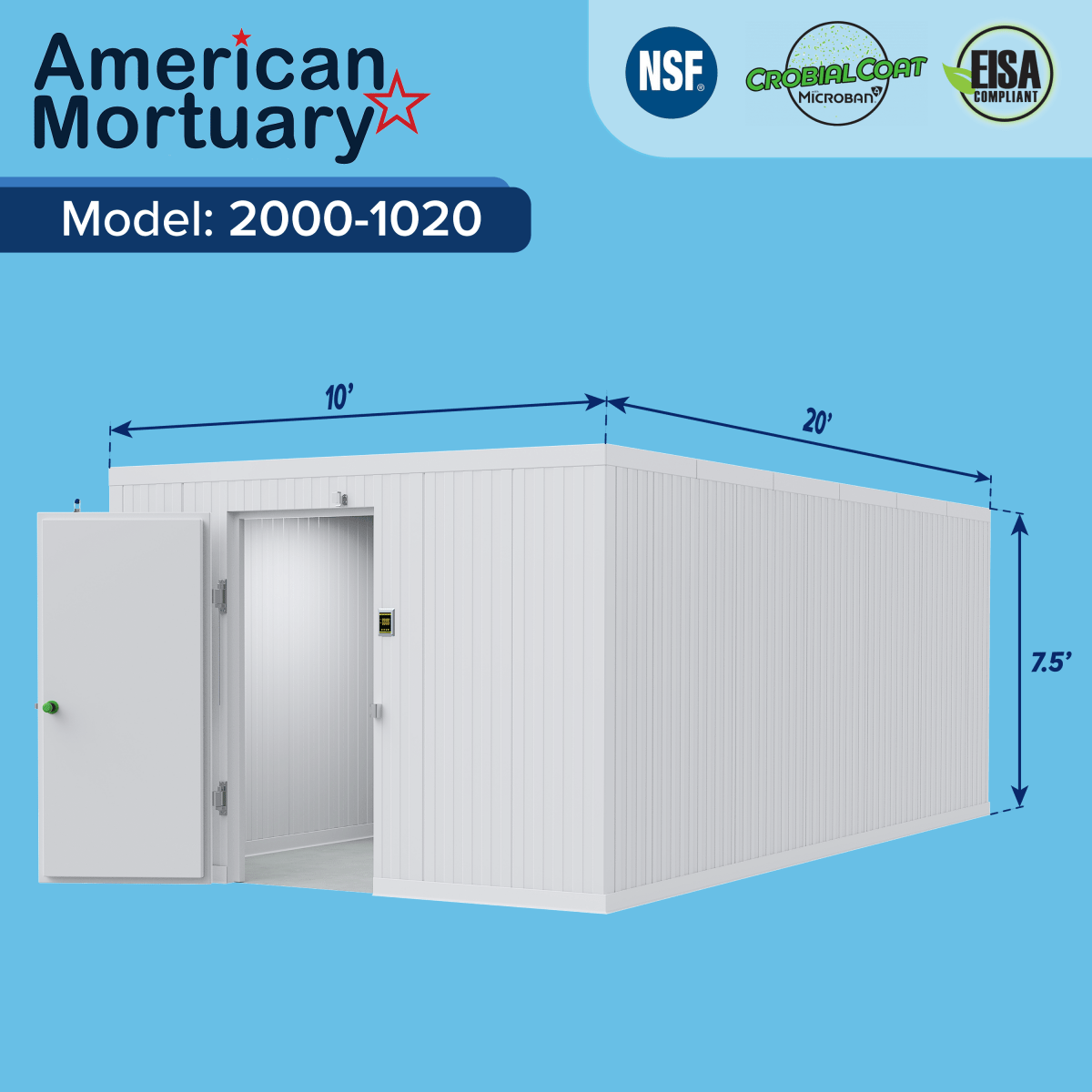

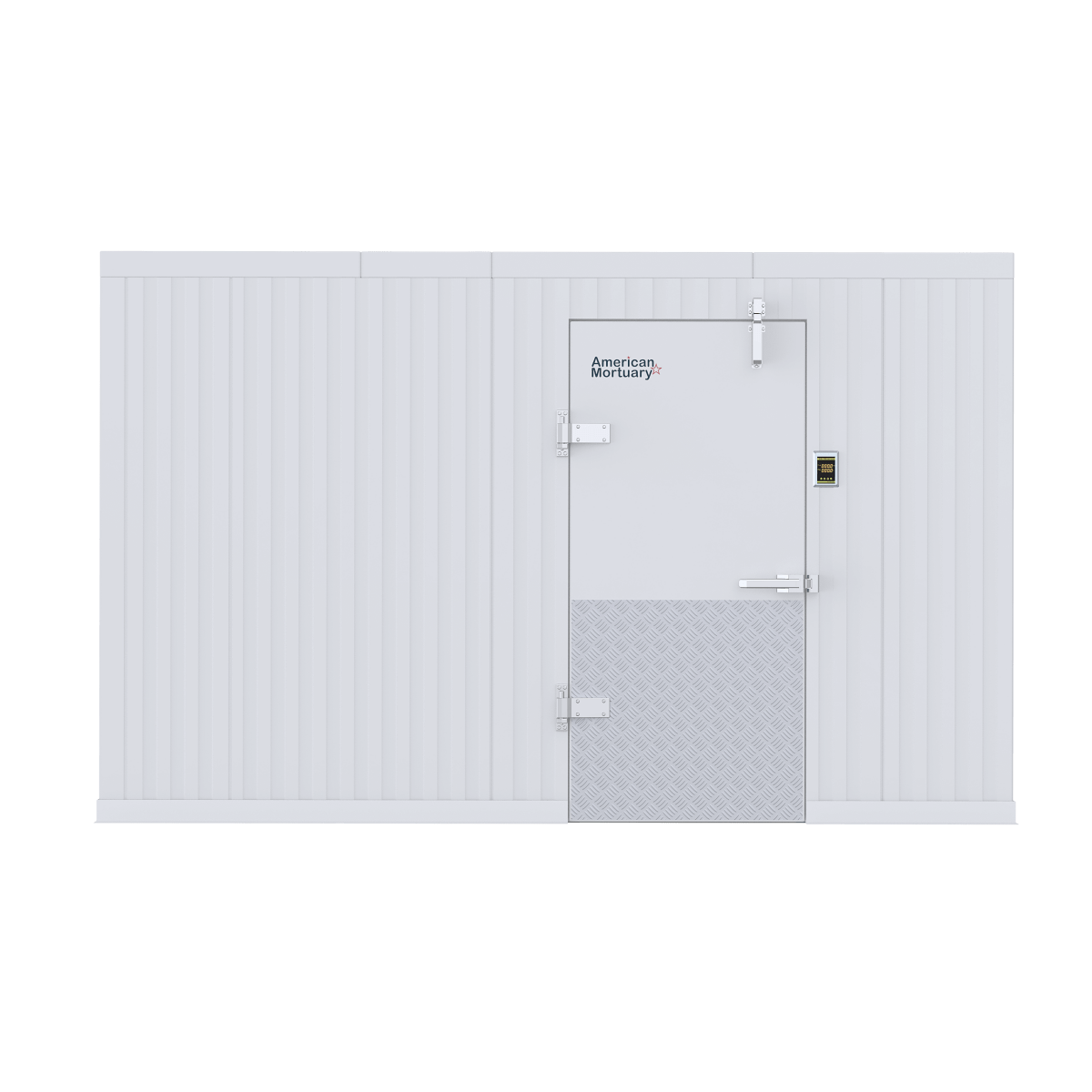

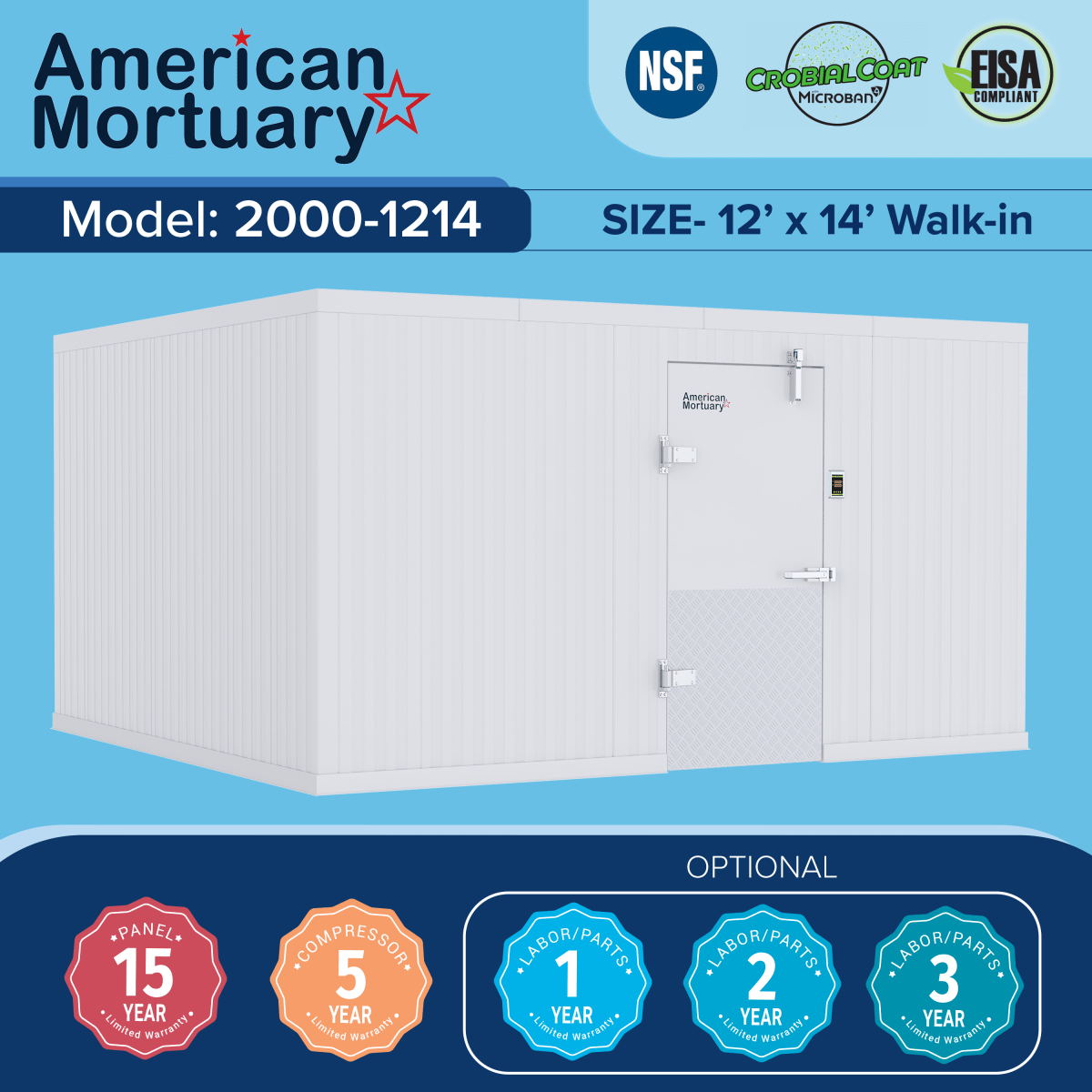

That said, checks maintain strong B2B relevance, especially for business transactions. Many funeral homes across the Midwest and Southeast still prefer checks when purchasing larger equipment like our walk-in coolers or freezers.

Bank Transfers & ACH – backbone of B2B

For moving larger sums of money, particularly between businesses, bank transfers and ACH payments form the solid foundation of modern commerce.

Wire transfers provide fast, secure movement of funds between banks, typically settling the same day. ACH transfers work through batch processing, usually taking 1-3 business days but offering lower fees than wires.

These methods shine brightest for substantial purchases like our mortuary coolers, especially when ordering multiple units. They're also ideal for recurring payments like maintenance contracts.

According to research on cart abandonment, offering these traditional payment methods alongside newer options can significantly reduce abandoned purchases, especially for higher-ticket items like our specialized equipment.

Digital & Emerging Payment Methods

The digital revolution has transformed how we pay, with new methods continually emerging to address specific needs and preferences.

Card Payments (Credit, Debit, Prepaid, Contactless)

Credit cards give you purchasing power on borrowed funds – perfect for larger purchases like our mortuary equipment. They offer robust consumer protections and rewards programs, though they typically carry interest rates between 15-25% APR.

Debit cards draw funds straight from your checking account. Funeral homes often prefer them for smaller purchases because they carry lower merchant fees (typically 0.5-2% compared to credit cards' 1.5-3.5%).

Prepaid cards offer a practical solution – you load them with a specific amount in advance. They're particularly useful for managing departmental spending.

Contactless technology has revolutionized in-person payments. These cards use NFC technology for tap-to-pay convenience, with transactions typically completed in under a second. Their popularity surged during the pandemic, with the UK seeing a 25% increase in just 12 months.

At American Mortuary Coolers, we accept all major credit and debit cards, with all our card processing meeting EMV (chip) technology standards and PCI DSS requirements.

Digital Wallets & Mobile Pay

Mobile wallets like Apple Pay, Google Pay, and Samsung Pay have made checkout lines move faster. Online wallets such as PayPal, Venmo, and Cash App have simplified everything from splitting dinner bills to purchasing equipment.

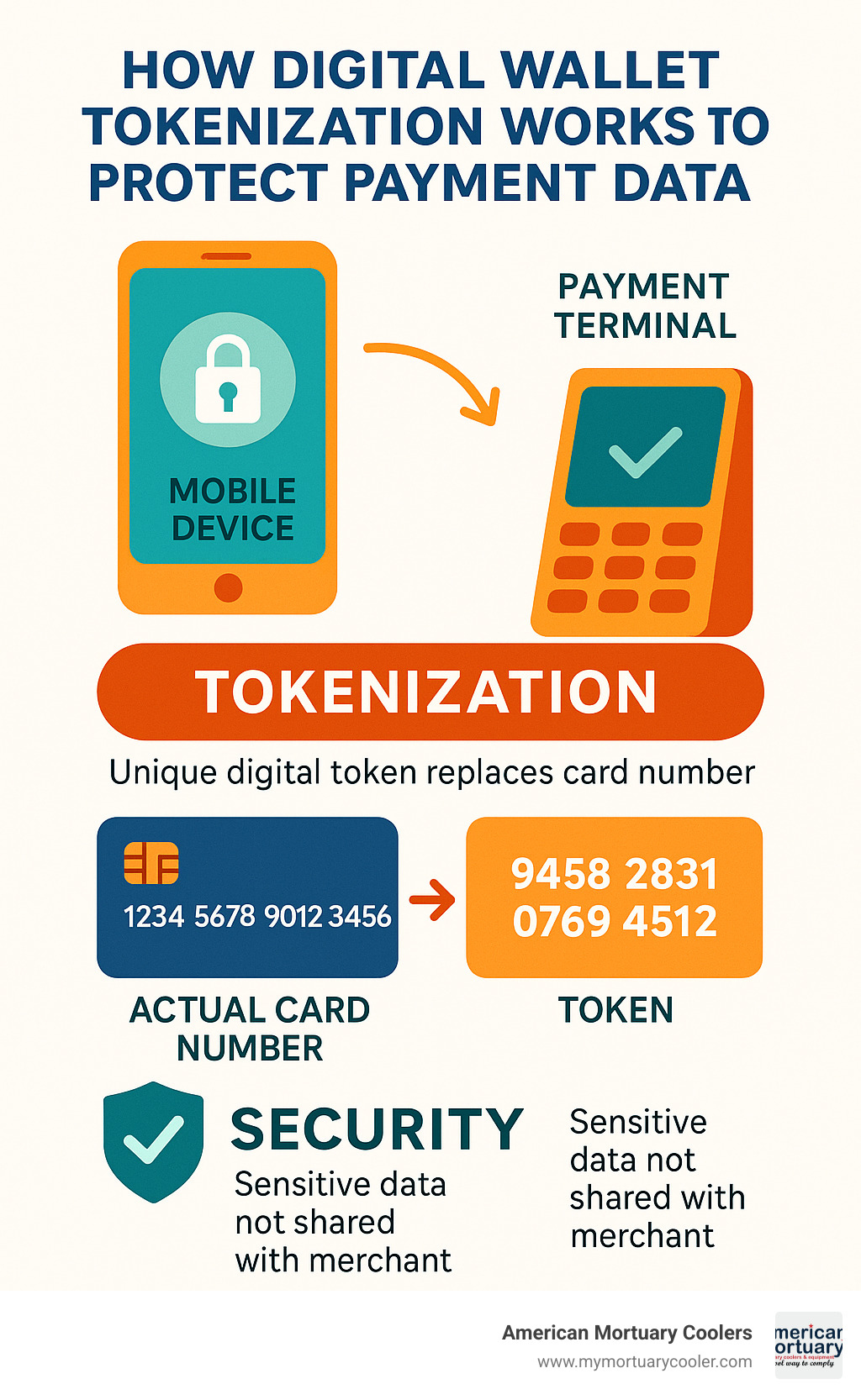

What makes these wallets special is their advanced security. Rather than transmitting your actual card number, they use tokenization to create unique codes for each transaction. Combined with biometric authentication, they're often more secure than traditional cards.

Buy Now, Pay Later & Installments

Buy Now, Pay Later (BNPL) services have exploded in popularity, with providers like Klarna, Afterpay, Affirm, and PayPal Pay in 4 leading the charge. These services typically split purchases into four equal payments over six weeks, often without interest or hard credit checks.

Research shows that 60% of consumers have tried BNPL, with 38% citing the ability to break costs into manageable installments as their primary motivation.

At American Mortuary Coolers, we offer several financing options: traditional financing from $500 to $500,000 with terms from 2-5 years, our "3 Easy Payments" plan for orders over $500, and our "4 Easy Payments" plan for larger purchases.

Cryptocurrency – blockchain frontier

While still emerging, cryptocurrency represents an intriguing evolution in how we think about money and payments.

Bitcoin, the original cryptocurrency, paved the way for thousands of digital currencies. For businesses concerned about volatility, stablecoins offer cryptocurrency benefits while being pegged to stable assets like the US dollar.

The benefits include faster settlement than traditional banking, reduced fees for international transfers, and freedom from central bank policies. However, challenges remain: price volatility, varying regulatory requirements, and complex tax implications.

At American Mortuary Coolers, we're keeping a close eye on cryptocurrency developments while focusing on more widely adopted payment methods that better serve our funeral home customers across all regions.

How to Choose the Right Mix of Payment Methods

Figuring out which payment methods to offer can feel like solving a puzzle. Too few options, and you might lose sales. Too many, and you could drown in complexity. Finding the right balance is crucial.

Cost & Fee Breakdown

Let's talk about what different payment methods cost your business:

- Credit card processing: 1.5-3.5% plus $0.10-0.30 per transaction

- Debit cards: 0.5-2% plus similar fixed fees

- Bank transfers/ACH: $0.20-1.50 per transaction or a small percentage

- Digital wallets: Around 2.9% plus $0.30 per transaction

- Buy Now, Pay Later: 2-6% of the sale

Don't forget hidden costs! Cash isn't "free" when you consider the time spent counting, securing, and depositing it. Checks require staff time and carry the risk of insufficient funds. Most electronic methods come with monthly fees for payment gateways or merchant accounts, plus chargeback fees ($15-100 per dispute).

In our experience serving funeral homes nationwide, offering financing options for higher-ticket items like mortuary coolers makes good business sense despite slightly higher costs.

Security & Fraud Mitigation

Each payment method comes with its own security profile:

- EMV chip technology has dramatically reduced in-person card fraud

- Online payments benefit from 3D Secure and Strong Customer Authentication protocols

- Tokenization replaces sensitive card data with non-sensitive equivalents

- Biometric authentication adds another security layer for mobile payments

Fraud is a growing concern—e-commerce fraud losses jumped 16% in 2022, costing merchants over $41 billion globally. The best approach balances security with convenience. Too many verification steps can frustrate customers, while too few can leave you vulnerable to fraud.

Legal & Regulatory Considerations

The payment world is heavily regulated:

- PCI DSS compliance is required for all businesses handling card data

- KYC/AML requirements apply to certain financial transactions

- Data privacy regulations like GDPR and CCPA affect how you handle payment information

- Tax reporting requirements vary by payment method

Non-compliance can result in hefty fines and damaged reputation. Working with established payment processors can help steer these complex requirements.

Managing Payment Methods in Practice

Running a business means dealing with the practical side of payments every day. It's not just about choosing which methods to accept—it's about making them work smoothly.

Handling Failed or Declined Payments

Smart retry strategies make a big difference when payments fail. Instead of immediately giving up, setting up automatic retry attempts at strategic times can recover many transactions.

Clear communication is essential when payments hit a snag. When we notice a payment issue with one of our mortuary cooler orders, we send a friendly, clear message explaining what happened and offering solutions.

Backup payment options can save the day when primary methods fail. We've helped many funeral directors switch to an alternative payment method when their original choice had issues.

For customers with payment plans, we've developed a gentle approach to following up on missed payments, understanding that funeral homes manage complex cash flows.

Updating & Expanding Payment Options

Testing new payment methods with a small group of customers first helps avoid disruption. When we introduced our "3 Easy Payments" plan, we rolled it out to long-term customers first to work out any kinks.

Listening to customer feedback has guided our payment evolution. When several funeral homes mentioned they preferred a specific regional payment option, we looked into adding it.

Regular analysis of payment data reveals valuable patterns. We've found that customers purchasing larger walk-in coolers often preferred financing options, while those buying smaller units typically used credit cards.

Regional preferences matter more than you might think. Our customers in rural areas sometimes prefer traditional methods like checks, while those in metropolitan areas like Los Angeles or Chicago tend toward digital options.

Frequently Asked Questions about Payment Methods

What are payment methods for online businesses?

When running an online business, your payment options become your digital handshake with customers. Most successful online stores offer a thoughtful mix of payment methods.

Credit and debit cards remain the workhorses of e-commerce. Digital wallets like PayPal, Apple Pay, and Google Pay have surged in popularity because they save customers from entering card details repeatedly. For larger purchases between businesses, bank transfers and ACH provide security and lower fees.

We've noticed that our funeral home customers increasingly appreciate Buy Now, Pay Later options when purchasing higher-value equipment. This makes sense; spreading payments can help with cash flow management during business expansions.

If your business operates internationally, consider region-specific methods like iDEAL in the Netherlands or Boleto in Brazil—these local favorites can significantly boost conversion rates in those markets.

How many payment methods should I offer?

Finding the sweet spot between choice and complexity is key. It's a bit like the Goldilocks principle—not too few, not too many, but just right.

Offer too few payment methods, and you risk losing sales. Up to 13% of shoppers will abandon their carts if they can't use their preferred payment method.

On the flip side, presenting too many options can overwhelm customers and complicate your checkout process. Research consistently shows that 3-5 payment methods hits the sweet spot for most businesses.

For specialized businesses like American Mortuary Coolers, we've found success focusing on just 3-4 high-quality options that align perfectly with our funeral home customers' needs: credit cards for standard orders, financing options for larger purchases, and bank transfers for substantial installations.

Which payment method is safest?

When it comes to payment safety, the answer depends on whether you're a consumer or a merchant.

For consumers, credit cards typically offer the strongest fraud protections. If someone makes unauthorized purchases, you can dispute charges and limit your liability. Digital wallets with biometric authentication add valuable security layers.

From a merchant perspective, push payments (where the customer initiates a bank transfer) virtually eliminate chargeback risk. Card transactions protected by 3D Secure or Strong Customer Authentication reduce fraud liability for merchants.

No payment method is 100% safe. The wisest approach is implementing multiple security layers regardless of which payment methods you accept. This includes data encryption, tokenization, and strong authentication practices.

Conclusion: Trends Shaping Tomorrow's Payments

The way we pay for things is changing faster than ever. Like watching your smartphone replace so many devices we once thought essential, payment methods continue to evolve in exciting ways.

Let's look at what's coming around the corner:

Real-time payments are becoming the new normal. Systems like FedNow in the US and PIX in Brazil are making instant money transfers possible, eliminating those anxious "has it cleared yet?" moments.

Embedded finance is quietly revolutionizing how we pay. Rather than visiting separate payment pages, payments are being woven directly into the platforms we already use.

The days of PINs and passwords are fading as biometric authentication takes center stage. Beyond just fingerprints and facial recognition, systems are beginning to recognize how you type or even how you hold your phone.

Open banking is breaking down walls between financial institutions, allowing secure access to your accounts through APIs. This means you can initiate payments directly from your bank account through trusted apps.

Finally, contextual commerce is putting buy buttons everywhere—from social media posts to smart refrigerators. Soon, you'll be able to purchase items the moment inspiration strikes, wherever you are.

At American Mortuary Coolers, we understand that funeral homes have unique payment needs. That's why we offer flexible, secure options that work for your business, whether you're in a small town in Tennessee or a busy city like Los Angeles.

We've seen how payment preferences vary across regions. Funeral homes in the Midwest often have different preferences than those in the Northeast, and we accommodate these differences with a range of solutions.

By understanding what are payment methods and how they affect your business, you can make choices that improve your cash flow, improve security, and ultimately provide better service to families during difficult times.

For more information about our payment options or to discuss custom financing for your mortuary equipment needs, reach out to our team. We proudly serve funeral homes across all regions—Midwest, Northeast, Rocky Mountain, Southeast, Southwest, and Pacific.