Financing Made Simple: Your Payment Options

Do you offer financing for mortuary coolers and equipment? Yes, we do offer financing through several flexible payment options designed specifically for funeral homes and mortuary businesses.

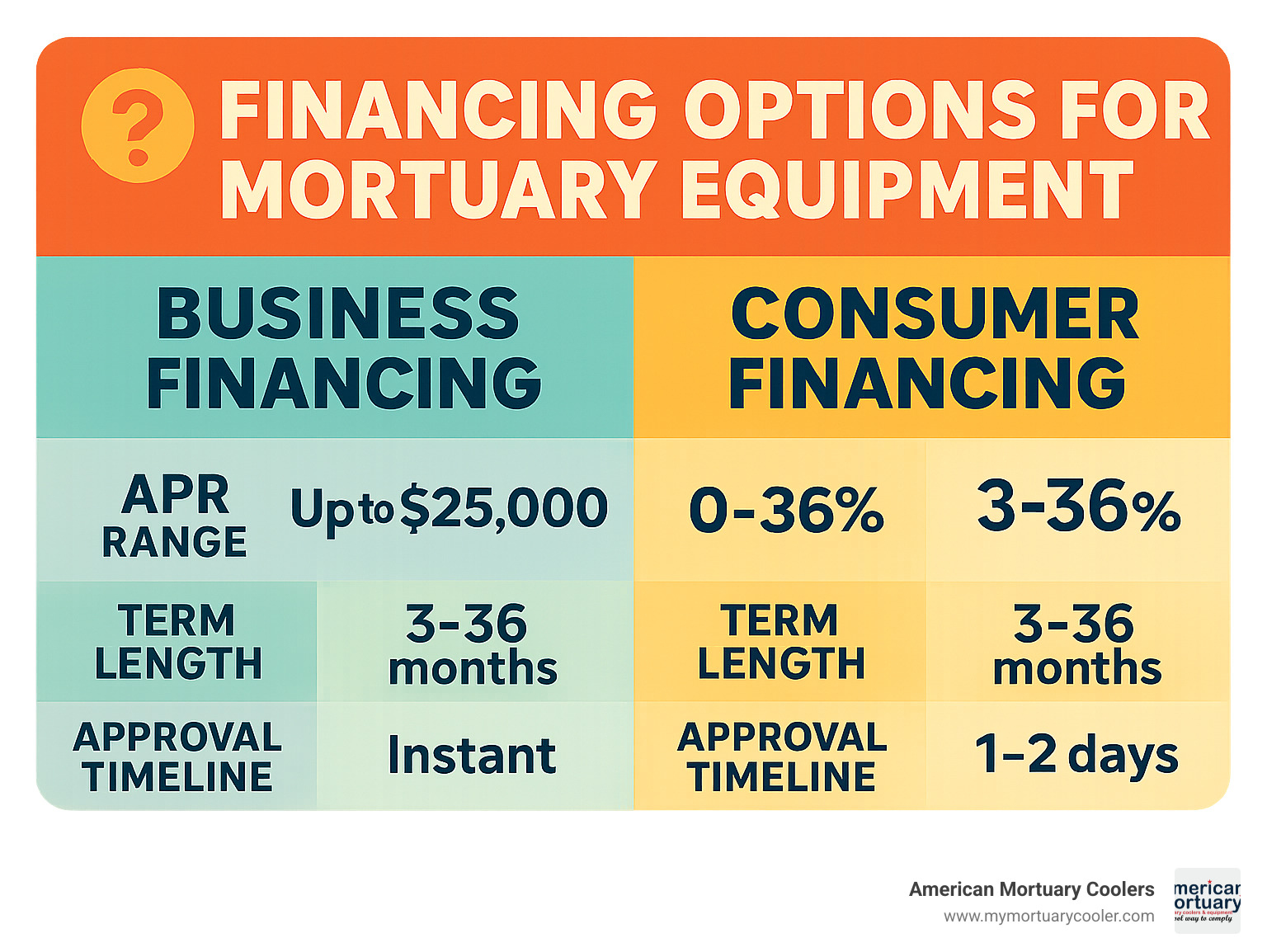

| Financing Options Available | Key Details |

|---|---|

| ✓ Business Financing | Up to $25,000 with instant approval |

| ✓ Consumer Financing | 0-36% APR with terms from 3-36 months |

| ✓ 0% Interest Options | Available for qualified buyers on 12-month terms |

| ✓ Minimum Purchase | $150+ for most financing plans |

| ✓ Application Process | Simple online application with quick decisions |

Purchasing mortuary equipment represents a significant investment for any funeral home. While a new mortuary cooler will save you money in the long run through energy efficiency and reliability, the upfront cost can be substantial. That's why we've partnered with trusted financing providers to offer payment plans that help you acquire the equipment you need without depleting your working capital.

Our financing options are designed with funeral directors in mind. Whether you're expanding your facilities, replacing outdated equipment, or dealing with an emergency breakdown, our payment plans can help you manage cash flow while still getting top-quality American-made mortuary coolers.

I'm Mortuary Cooler, a national-level mortuary cooler supplier with extensive experience helping funeral homes steer the "do you offer financing" question through customized payment solutions that keep businesses running smoothly. My team specializes in connecting funeral directors with the right financing partners based on their specific business needs and equipment requirements.

Do you offer financing definitions:

Understanding Your Financing Options

When folks ask us "Do you offer financing?", we're thrilled to say yes! At American Mortuary Coolers, we've created relationships with several financing partners because we understand that every funeral home has unique financial circumstances. We want to make it easy for you to get the equipment you need without emptying your bank account.

Did you know that offering financing typically increases sales by 20%? That's because payment flexibility matters when you're making a significant investment in your business. When you finance your mortuary cooler, you can keep your working capital available for other important expenses while still getting the high-quality equipment your funeral home deserves.

We offer several financing pathways:

Business Equipment Financing designed specifically for funeral homes, with approvals up to $25,000. This option is perfect for established businesses looking to upgrade their facilities.

Consumer Financing Plans work well for individual owners or smaller operations who prefer personal financing options.

Lease-to-Own Programs let you spread payments over time, with the option to own your equipment when the term ends.

0% APR Promotional Financing is available for qualified buyers on select terms – who doesn't love interest-free payments?

The application process is straightforward and typically requires just some basic information about your business: your business name and contact details, how long you've been operating, your estimated annual revenue, and some personal information for the business owner(s). Most applications involve only a soft credit check, which won't affect your credit score. A hard inquiry only happens when you decide to move forward with a specific financing offer.

More info about smart financing for equipment

Consumer Plans vs. Business Leasing

When customers ask "Do you offer financing?", we explain that there are two main financing routes you can take: consumer plans and business leasing options.

For Consumer Financing Plans, we partner with trusted providers like Affirm, which offers rates from 0-36% APR with flexible terms of 3, 6, 12, 18, 24, or 36 months. We also work with PayPal Credit, which provides a revolving credit line with special promotional offers. These options generally require a minimum purchase of $150, feature a simple online application, and provide real-time decisions. They're ideal for individual owners, smaller purchases, or personal use cases.

Our Business Leasing Options include partners like Clicklease, which specializes in business equipment financing with instant approvals up to $25,000, and Advantage Leasing, our dedicated partner for walk-in cooler leasing. A major benefit of business leasing is that your payments may be fully tax-deductible as a business expense (though you should always check with your tax advisor). We welcome all credit scores and have options for various credit profiles. These options are perfect for established funeral homes, larger equipment purchases, and when you want business tax benefits.

The key difference between loans and leases comes down to ownership. With a loan, you own the equipment from the start and build equity with each payment. With a lease, you're essentially renting the equipment with an option to purchase at the end of the term, usually for a nominal fee.

Many funeral directors find business leasing particularly advantageous because it preserves working capital, offers potential tax benefits, provides flexible end-of-term options (return, upgrade, or purchase), and may even include maintenance and service in the payment.

As one of our customers, Jeff Kerr, told us: "The leasing option allowed us to acquire a new mortuary cooler during an emergency situation without depleting our cash reserves. The tax benefits were an added bonus."

Typical Interest Rates & Terms

When people ask "Do you offer financing?", they're usually most concerned about dollars and cents – specifically, what interest rates and terms we can offer. Here's the straightforward breakdown of what you can expect:

Our interest rates range from as low as 0% APR for qualified buyers on promotional financing all the way up to 36% APR, depending on creditworthiness. For business leasing, rates typically start at a competitive 7.99% APR.

We offer flexibility in term lengths to fit your budget. Need a shorter commitment? Choose from 3, 6, or 12-month terms. Looking for more manageable monthly payments? Our medium-term options include 18 or 24 months. For larger investments, our business leasing extends to 36, 48, or even 60-month terms.

To give you a real-world example, if you finance a $10,000 mortuary cooler at 7.99% APR for 60 months, your monthly payment would be approximately $202.72. For a smaller purchase of $1,200 at 8.9% APR for 12 months, expect to pay around $104.89 per month.

We regularly offer special promotions that can make financing even more attractive. These might include 0% APR for 12 months on select models, no payments for the first 90 days, or reduced interest rates for qualified buyers.

Your specific interest rate will depend on several factors, including your personal or business credit score, how long you've been in business, your annual revenue, existing debt obligations, and the loan amount and term length you choose.

Rest assured, we only partner with lenders who provide transparent terms with no hidden fees or penalties. You'll always know exactly what you're paying over the life of your financing agreement.

External guide to Affirm rates

Do You Offer Financing? Everything You Need to Know

Do you offer financing? Yes, we do! Here at American Mortuary Coolers, we've partnered with several trusted financing providers to make purchasing your essential mortuary equipment more manageable. We understand that quality equipment is an investment, which is why we've created flexible payment options that work for both businesses and individuals while helping you preserve your working capital.

When funeral directors ask about financing, they usually want the complete picture. Let me walk you through everything you need to know about our payment options.

Our financing partners understand the unique needs of the funeral industry. Whether you're replacing an emergency breakdown or planning a facility upgrade, we've got options that can help you move forward without depleting your cash reserves.

What types of financing do you offer? We provide business equipment financing through Clicklease, consumer-friendly options through Affirm and PayPal Credit, and specialized equipment leasing through Advantage Leasing. Each option has its own benefits depending on your specific situation.

The application process couldn't be simpler – most can be completed online in just a few minutes. The best part? Most customers receive their decision almost instantly, allowing you to move forward with your purchase right away.

There is a minimum purchase requirement of $150 for most financing options, though some of our business programs may have slightly higher minimums. For larger purchases, business financing is available up to $25,000 through Clicklease, while consumer financing limits vary based on your creditworthiness and the specific program you choose.

Some customers ask about down payments – this varies by program. Some options finance the full amount, while others (like our leasing program) typically require a 10% deposit to secure your order's ship date.

How quickly can I get approved? Speed is one of the advantages of our financing options. Most applications receive an instant decision, with business financing through Clicklease offering approvals in as little as 4 minutes. This means you can complete your entire purchase in under 10 minutes – less time than it takes to enjoy your morning coffee!

One of the most helpful features is that you can finance complete packages – not just the mortuary cooler itself. This includes accessories, installation costs, and extended warranties, creating a comprehensive solution with manageable monthly payments.

Do You Offer Financing for Individuals?

Do you offer financing for individuals? Absolutely! We provide consumer financing options through Affirm and PayPal Credit that are perfect for individual buyers or funeral directors who prefer personal financing arrangements.

Our consumer options are designed with clarity and simplicity in mind. With Affirm, you'll find APRs ranging from 0-36% based on your creditworthiness, with flexible terms of 3, 6, 12, 18, 24, or 36 months. The minimum purchase is just $150, making this accessible for various equipment needs.

One thing our customers appreciate is the soft credit check for pre-qualification, which doesn't impact your credit score. A hard credit pull only happens when you decide to move forward with the financing option.

The application process takes just moments:

- Select Affirm at checkout

- Provide some basic personal information

- Get your decision in seconds

- Select your preferred payment plan

- Complete your purchase

"I was able to finance a mortuary transport stretcher through Affirm with 0% interest for 12 months," shared one of our customers recently. "The process was incredibly simple, and I had my approval within seconds."

This type of financing works wonderfully for small funeral homes with individual owners, start-up businesses not yet established enough for business financing, emergency purchases when time is of the essence, or purchases that fall below typical business financing thresholds.

Do You Offer Financing for Businesses?

Do you offer financing for businesses? We certainly do! American Mortuary Coolers has formed strong partnerships with specialized business equipment financing providers like Clicklease to create custom solutions specifically for funeral homes and mortuary businesses.

Our Clicklease Business Equipment Financing offers instant approvals up to $25,000 and welcomes all credit scores. There's no hard credit pull required for application, which helps protect your credit rating. You'll find custom payment and lease terms to fit your business needs, plus potentially tax-deductible payments (though we always recommend consulting your tax advisor about your specific situation).

The application process takes just 4 minutes, and you can complete your entire purchase in under 10 minutes – efficiency that busy funeral directors appreciate.

For larger installations, our Advantage Leasing program specializes in walk-in coolers with flexible lease terms. This option typically requires a small initial down payment (around 10%) and provides fixed monthly payments that make budgeting simpler. Many funeral homes choose this option because it helps preserve working capital and keeps business credit lines open for other needs.

Business financing is particularly valuable for established funeral homes making significant equipment investments, businesses focused on maintaining healthy cash flow, companies looking for potential tax advantages through leasing, and those making multiple-unit purchases or complete system installations.

As required by the USA Patriot Act, financial institutions must verify certain identifying information for new accounts. We want to assure you that all your information is handled securely and in full compliance with federal regulations.

Applying for Financing: Step-by-Step Guide

When folks ask us "Do you offer financing?", we don't just say yes and leave you hanging. We want to walk you through exactly how to get the funds you need for your mortuary equipment with minimal hassle. Let me guide you through the whole process from start to finish.

Getting financing for your mortuary cooler is actually pretty straightforward. First, you'll need to decide whether business or consumer financing makes more sense for your situation. Take a moment to think about your budget and how long you'd like to spread out payments. We offer some great promotional rates that might be perfect for your needs!

Before you sit down to apply, gather your paperwork. For business financing, you'll want your business tax ID or EIN, some basic bank account details, and information about your business finances. For personal financing, you'll just need your ID, contact details, and the last four digits of your Social Security Number for the initial pre-qualification.

The application itself is a breeze – most people complete it in just 3-5 minutes through our website. Just click "Apply for Financing" and select your preferred lender. For business owners, you'll fill out sections about your company, the principals involved, and the equipment you're looking to purchase. If you're applying as an individual, the form is even simpler.

Once you submit your application, the magic happens! You'll typically receive an offer outlining your approved terms, including your interest rate, monthly payment amount, and how long you'll be paying. Take your time to review everything carefully – we want you to feel completely comfortable with your financing plan.

When you're ready to move forward, just electronically sign the agreement, and we'll get your order processed right away. For custom coolers, we'll start building to your specifications, and for in-stock items, we'll prepare for shipment to your location anywhere in the lower 48 states.

| Documentation | Business Financing | Consumer Financing |

|---|---|---|

| ID Verification | Business Tax ID/EIN + Owner ID | Government-issued ID |

| Financial Info | Business Bank Statements | Personal Banking Info |

| Credit Check | Soft Pull (No Impact) | Soft Pull for Pre-qualification |

| Time to Complete | 4-5 Minutes | 2-3 Minutes |

| Approval Time | Minutes to Hours | Seconds to Minutes |

| Signature Required | Electronic | Electronic |

Many of our customers are pleasantly surprised by how smooth the whole process is. As Sarah from a family-owned funeral home in Ohio told us, "I was expecting a mountain of paperwork and days of waiting, but I had approval in minutes and my new cooler was on its way by the end of the week!"

Pre-qualification & Credit Checks

I know what you're thinking – "What about my credit score?" It's one of the most common concerns when people ask "Do you offer financing?" The good news is that we've designed our process to be as credit-friendly as possible.

We use a two-stage approach that protects your credit score while you're exploring options. When you first check your eligibility, we perform only a soft credit inquiry. This is like peeking at your credit without leaving fingerprints – it doesn't affect your score at all. You'll get to see estimated rates and terms based on this preliminary look, which helps you make an informed decision without any commitment.

Only when you decide "Yes, this plan works for me!" and choose to move forward with a specific offer does a hard credit inquiry come into play. This will appear on your credit report and might temporarily lower your score by a few points. But here's the thing – this is standard practice for any financing, whether you're buying a mortuary cooler or a new couch.

For our business customers, we've got even better news. Our partner Clicklease evaluates business creditworthiness through alternative data points, often without needing a hard pull on your personal credit. They understand that a business is more than just its owner's credit score.

One funeral director I worked with was particularly relieved about this approach. "I was in the middle of refinancing my home and was worried about additional credit inquiries," he told me. "Being able to see my options without impacting my score was exactly what I needed."

The pre-qualification step is all about giving you information without obligation. It's like trying on clothes before buying them – you want to make sure everything fits perfectly before you commit.

Receiving a Decision & Next Steps

After you submit your financing application, the waiting game is typically very short. In fact, most of our customers hear back within minutes! Here's what happens next, depending on your application's outcome:

If you receive a full approval – congratulations! You'll see all your approved terms right away, including your interest rate and monthly payment amount. With just a few clicks to electronically accept the offer, you can complete your purchase and we'll start preparing your mortuary cooler for production or shipment. It really is that simple!

Sometimes, you might receive a partial approval. This means you're approved for some, but not all, of the requested amount. For instance, if you applied to finance a $9,000 cooler but were approved for $7,000, you'd need to cover the $2,000 difference as a down payment. Many customers actually prefer this option as it reduces their monthly payments while still helping them get the equipment they need.

Occasionally, your application might come back as pending additional information. Don't worry – this isn't a rejection! It simply means the lender needs to verify a few details before giving final approval. You'll receive clear instructions about what documentation is needed, whether it's proof of income or additional business information.

In the rare case that your application is declined, we won't leave you hanging. We can suggest alternative financing options or the possibility of applying with a co-applicant. Sometimes it's just a matter of timing, and reapplying after addressing certain factors can lead to approval.

What about the money? Once approved, funding happens quickly:

- With consumer financing through Affirm or PayPal Credit, American Mortuary Coolers receives the funds immediately

- Business financing through Clicklease typically funds the same day or next business day

- Equipment leasing payments are usually released upon delivery confirmation

"The speed of the whole process was what impressed me most," shared Mike, a funeral home owner from Texas. "From application to approval to having my new cooler delivered took less than two weeks. And the best part was spreading the payments over 36 months, which helped my cash flow tremendously."

For custom-configured mortuary coolers, we generally recommend securing your financing before we begin production. This ensures everything moves smoothly from approval to delivery, getting you the equipment you need without unnecessary delays.

Managing Your Financing: Payments, Fees & Early Payoff

Congratulations on your approved financing! Now that your mortuary equipment is on its way, let's talk about how to manage your payments going forward. After all, a smooth payment experience is just as important as getting the right equipment for your funeral home.

Setting up your payments is designed to be hassle-free. Most of our financing partners offer automatic payments that can be linked directly to your bank account or credit card. This "set it and forget it" approach means you'll never have to worry about missing a due date. You'll also have access to a convenient online portal where you can view your balance, payment history, and manage your account 24/7.

"The online payment system through Clicklease made managing my mortuary cooler payments incredibly simple," shares Maria, a funeral director from Colorado. "I receive email reminders three days before each payment, which gives me peace of mind."

When it comes to understanding fees, transparency is our priority. Some financing options do include a one-time account activation fee (like the $69 setup fee for the Generac Credit Card). You should also be aware of potential late payment fees (typically 5-10% of your payment amount) and returned payment fees (usually $25-35 if a payment doesn't go through). If you choose revolving credit, there might be annual fees to consider as well.

One of the most common questions we hear is about paying off your financing early. Here's the good news: all of our financing partners allow early payoff with absolutely no penalties. Paying early can save you significant money on interest, especially on longer-term financing. Simply request a payoff quote from your lender to get the exact amount needed to close your account.

It's worth noting that if you've taken advantage of promotional financing (like "no interest if paid in full within 12 months"), you'll need to pay the entire balance before the promotional period ends to avoid all accrued interest charges.

Did you know that 76% of U.S. consumers are more likely to make a purchase when a simple payment plan is offered? That's why we've structured our financing options to provide that simplicity while being completely upfront about all costs involved.

More info about affordable solutions

How Are Monthly Payments Calculated?

Understanding how your monthly payments are calculated helps you plan your budget with confidence. While the math might seem complicated, the concept is straightforward.

For standard fixed-rate financing, your monthly payment is determined using a formula that accounts for your loan amount (the principal), your interest rate (the APR), and your term length (how many months you'll be paying).

Here's a real-world example: If you finance a $10,000 mortuary cooler at 7.99% APR for 60 months, your monthly payment would be approximately $202.72. This amount stays the same throughout your entire term, making it easy to budget for.

Promotional financing works a bit differently. For "no interest if paid in full" promotions, the lender typically sets a minimum monthly payment calculated as a percentage of your highest balance. For instance, with Generac's 18-month no-interest promotion, the minimum payment is 2.5% of the highest balance. So on a $5,000 purchase, your minimum monthly payment would be $125.

But here's an important tip: With promotional financing, making only the minimum payment often won't pay off the balance before the promotional period ends. To avoid interest charges, I recommend dividing your total purchase by the number of months in the promotion. For a $5,000 purchase with an 18-month promotion, you'd want to pay about $278 per month to ensure you're paid in full before interest kicks in.

Some financing options use a simpler approach with fixed percentage payments. For example, a plan with 9.99% APR might set monthly payments at 1.25% of your highest balance. On an $8,000 purchase, that's a $100 monthly payment.

When you're comparing financing options, I'm always happy to help you calculate exactly what you'll pay each month so there are no surprises.

What Happens If I Miss a Payment?

Life happens. Even with the best intentions, financial challenges can arise unexpectedly. If you find yourself unable to make a payment on time, here's what you should know:

Most of our financing partners offer a grace period of 10-15 days before any late fees are assessed. This gives you a little breathing room if payday doesn't quite align with your due date. After the grace period, you'll typically face a late fee (usually 5-10% of your payment amount).

If a payment goes beyond 30 days late, it may be reported to credit bureaus, which could affect your credit score. You'll receive several notifications via email, text, and/or mail before this happens, giving you ample opportunity to address the situation.

The best advice I can give you: If you anticipate payment difficulties, contact your lender immediately. Don't wait until you've already missed a payment. Most lenders are surprisingly understanding and willing to work with you, especially if you reach out proactively.

"When our funeral home faced unexpected expenses after a major renovation, I called Clicklease to explain the situation," shares James, a funeral director from Texas. "They worked with me to adjust my payment schedule temporarily. That kind of flexibility was invaluable."

Many of our financing partners offer assistance options during genuine hardship situations, including:

- Temporary payment deferment during proven financial hardship

- Modified payment plans that better fit your current situation

- Restructured terms to make payments more manageable

To avoid missed payments altogether, consider setting up automatic payments, creating calendar reminders several days before due dates, and maintaining a small buffer in your payment account. Some customers even find that making biweekly half-payments helps them stay ahead of schedule.

Communication is key. A single missed payment doesn't have to derail your financing – but ignoring the problem definitely will. We're here to help you steer any payment challenges that arise during your financing term.

Pros, Cons & Special Promotions

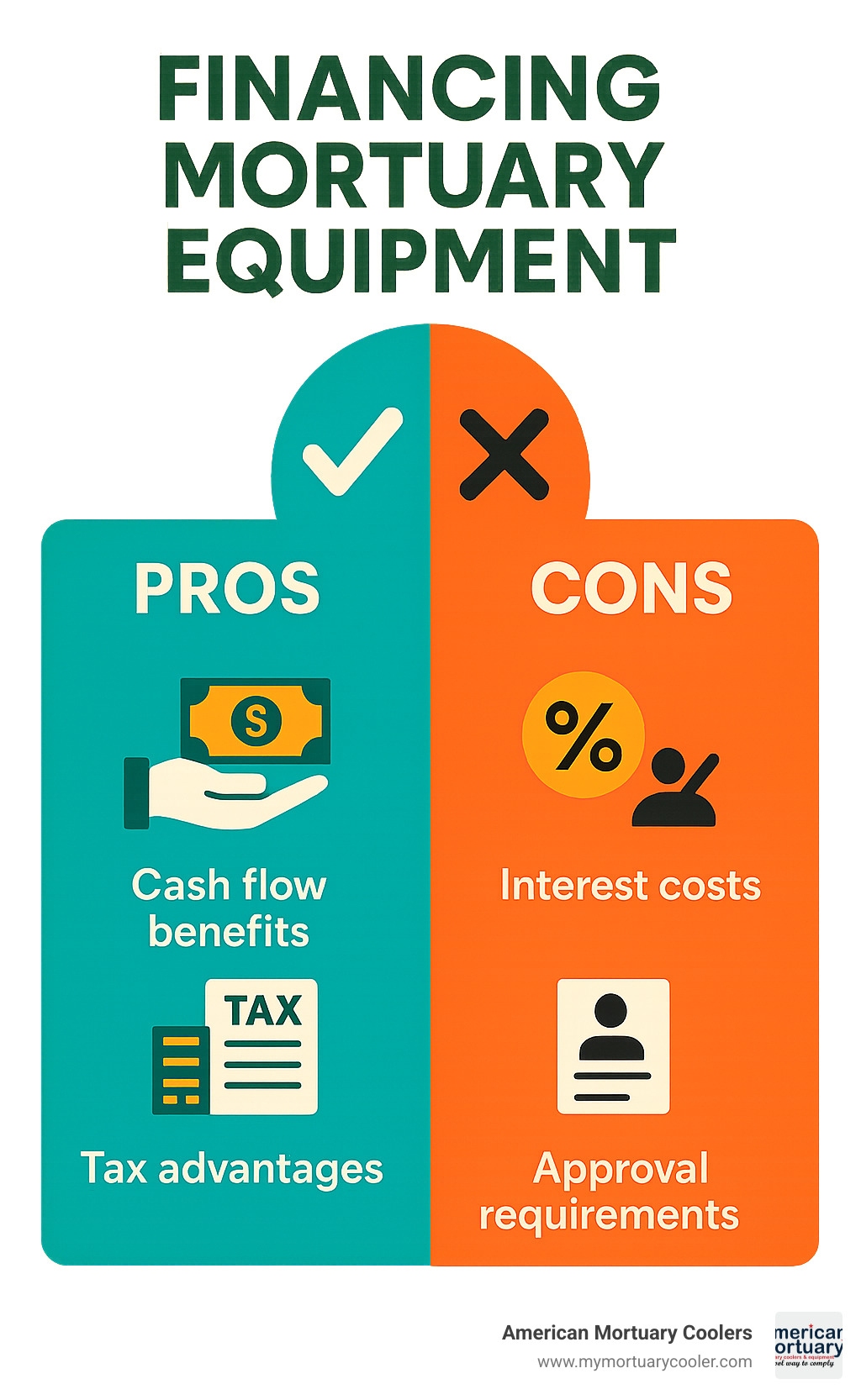

When customers ask "Do you offer financing?", we believe in providing a balanced view of the advantages and potential drawbacks of financing your mortuary equipment purchase. After all, it's a significant decision that affects your funeral home's operations and finances for years to come.

I'm excited to share our current special promotions with you! Right now, we're offering 0% APR for 12 months on select mortuary cooler models, which has been incredibly popular with our funeral home clients. We also have a "no payments for 90 days" option on business equipment financing that gives you breathing room while you install and integrate your new equipment.

For qualified buyers, we've negotiated reduced interest rates with our financing partners, and we're offering special bundle discounts when you finance multiple pieces of equipment together. These promotions do change periodically (we're always looking for new ways to make equipment more affordable), so I encourage you to give us a call for the most current offers available.

Benefits of Using Financing

Financing your mortuary equipment purchase offers several significant advantages that I've seen make a real difference for our funeral home clients.

Preserve Working Capital is perhaps the benefit I hear about most often. Rather than depleting your savings or emergency funds, financing allows you to maintain cash reserves for other business needs. One funeral director told me, "Having that cash cushion gave us peace of mind during an unexpected slow period." It also keeps your existing lines of credit available for day-to-day operations.

The Tax Advantages can be substantial too. If you're financing through a business lease, those payments may be fully tax-deductible as a business expense. Many of our clients also take advantage of the Section 179 deduction for financed equipment purchases. (I always recommend consulting your tax advisor for specific guidance custom to your situation.)

I love seeing clients Access Better Equipment through financing. Instead of settling for a basic model, you can upgrade to higher-quality, energy-efficient coolers that will save you money over time. You can include additional features that improve functionality and bundle with extended warranties and service plans. One client recently told me, "We were able to get the three-body cooler with digital temperature controls instead of the basic two-body unit we would have bought with cash."

Improved Cash Flow Management is another practical benefit. With predictable monthly payments, budgeting becomes much easier. You can align equipment costs with the revenue it generates, essentially letting the equipment "pay for itself" over time. Spreading large purchases over a comfortable timeframe means less financial stress on your business.

The ability for Quick Acquisition has saved many of our clients during emergencies. When a cooler fails unexpectedly, financing allows you to obtain needed equipment immediately rather than waiting until you've saved enough. You can also take advantage of limited-time pricing or promotions without delay.

Studies show that customers with access to monthly payment plans typically spend up to 20% more on upgraded services and features, allowing funeral homes to acquire better equipment than they might with a cash-only approach.

Potential Drawbacks to Consider

While financing offers many benefits, I believe in being completely transparent about potential considerations before you make your decision.

Interest Costs are the most obvious consideration. Unless you're using our 0% promotional financing, you'll pay interest over time, which increases the total cost of ownership compared to an all-cash purchase. Interest rates vary based on creditworthiness and market conditions. However, many clients find that the benefit of keeping cash in their business outweighs this cost – especially when considering the time value of money.

Approval Requirements can be challenging for some businesses. Financing approval depends on credit history and business stability. If you have a newer funeral home, you might face higher rates or require larger down payments. Some of our financing options also have minimum purchase requirements, typically starting at $150.

The Commitment to Payments is something to carefully consider. Financing creates a fixed monthly obligation for the term of the agreement. If your business experiences seasonal fluctuations, you'll need to plan accordingly. Early termination may require paying the remaining balance, though none of our financing partners charge prepayment penalties.

There are more Documentation Requirements with financing than with a direct cash purchase. The application process requires financial disclosure, and business financing may require business financial statements. However, we've worked hard with our partners to streamline this process as much as possible.

Despite these considerations, most of our customers find that the benefits of financing—particularly the ability to preserve working capital while acquiring needed equipment—outweigh the potential drawbacks.

As one funeral director in Georgia told me: "The interest cost was minimal compared to the benefit of keeping our cash reserves intact. The tax deduction on lease payments was an added bonus that made financing the clear choice for our mortuary cooler upgrade."

Frequently Asked Questions about Financing

What is the minimum and maximum amount I can finance?

"Do you offer financing for smaller purchases?" is a question we hear often. Yes! Our consumer financing options, like Affirm, start at just $150, making even smaller accessories and equipment components accessible through monthly payments.

For business owners, while there's no strict minimum requirement, most practical business equipment financing starts around $500 simply due to the nature of mortuary equipment costs.

As for maximum amounts, you'll find our financing options quite generous:

Most funeral directors are pleasantly surprised to learn that our Clicklease business financing offers instant approvals up to $25,000 - more than enough for most mortuary cooler models. For established businesses looking at our larger walk-in units or multiple pieces of equipment, our specialized equipment leasing programs can accommodate even higher amounts.

Some customers may qualify for up to $40,000 through our WeGetFinancing partnership, depending on their specific situation and creditworthiness.

Rest assured that virtually all our mortuary coolers and related equipment fall comfortably within these financing ranges, making quality equipment accessible for funeral homes of all sizes.

Will applying affect my credit score?

This is perhaps the most common concern when customers ask "Do you offer financing?" The good news is that our initial pre-qualification process uses only a "soft credit pull" that has absolutely no impact on your credit score.

Think of it as a behind-the-scenes peek at your potential rates and terms - completely risk-free. You can explore your options without any worries about your credit score taking a hit.

Only when you decide "yes, this financing plan works for me" and choose to proceed with a specific offer would a "hard inquiry" appear on your credit report. This might temporarily lower your score by a few points, but there's more good news: if you're shopping around for financing, multiple applications for the same purpose within a short timeframe (typically 14-45 days) usually count as just a single inquiry.

Business owners will appreciate that our Clicklease business financing doesn't require a hard credit pull at all, making it perfect for preserving your personal credit score while still getting the equipment your funeral home needs.

As one of our financing partners puts it: "Checking eligibility or creating an account won't affect your credit score; actual purchases may require a hard credit check by the lender."

Can I pay off my financing early without penalty?

Absolutely! All of our financing partners allow early payoff with zero penalties or hidden fees. We believe in giving you complete flexibility with your payment schedule.

Paying off early can save you significant interest costs. For example, if you have a 36-month plan but find yourself with extra funds after 24 months, paying off a year early could save you 12 full months of interest charges. That's money back in your pocket!

For our special promotional "no interest if paid in full" offers, early payoff isn't just an option – avoid retroactive interest. These promotions typically require complete payment by the end of the promotional period to avoid all accrued interest charges.

The early payoff process is straightforward:

- Contact your lender for your current payoff amount (this changes daily as interest accrues)

- Request simple payoff instructions

- Make the payment through your preferred method

- Confirm receipt and account closure for your records

Many of our funeral director customers choose a middle path – making larger monthly payments than required to pay down their balance faster, while still maintaining the flexibility of having the payment plan in place. This approach works particularly well for seasonal businesses that might have cash flow fluctuations throughout the year.

Conclusion

When customers ask "Do you offer financing?", we're proud to answer with a resounding yes! We've worked hard to create multiple flexible options that truly meet the diverse needs of funeral homes and mortuary businesses across the country.

Financing your mortuary cooler isn't just about spreading out payments—it's a smart business decision that offers real advantages. You'll preserve your valuable working capital for other pressing business needs while enjoying predictable monthly payments that make budgeting so much easier. For business purchases, you might even enjoy some nice tax benefits (though you'll want to chat with your tax advisor about your specific situation).

Perhaps best of all, financing opens doors to higher-quality equipment with better features that might otherwise be out of reach. When you're facing an urgent need—like when that old cooler finally gives out during the hottest week of summer—financing enables you to act immediately rather than waiting until you've saved up enough cash.

At American Mortuary Coolers, we've carefully chosen financing partners we trust to create an experience that's truly seamless from application all the way through approval. We understand that every situation is unique—whether you're running a large established funeral home with multiple locations, a growing business expanding your services, or an individual owner managing everything yourself—and we have financing solutions custom to fit your specific needs.

Our friendly team is standing by, ready to guide you through the entire financing process. We'll help you select the right option for your particular situation without pushing you toward something that doesn't make sense for your business. With locations across the country—including Johnson City TN, Atlanta GA, Chicago IL, and more—we provide not just nationwide delivery but also personalized support for all your financing questions.

We see financing as more than just a payment method—it's a strategic business tool that helps you get the equipment you need while maintaining your financial flexibility. Our financing partners approve thousands of applicants every month, which gives us confidence that we can help you find a solution that works beautifully for your situation.

Ready to explore your options for financing that new mortuary cooler? Our team would love to chat about your specific needs and guide you toward the best financing path for your business. Just reach out—we're here to help!