Why Waud Capital Partners LLC Matters in Today's Private Equity Landscape

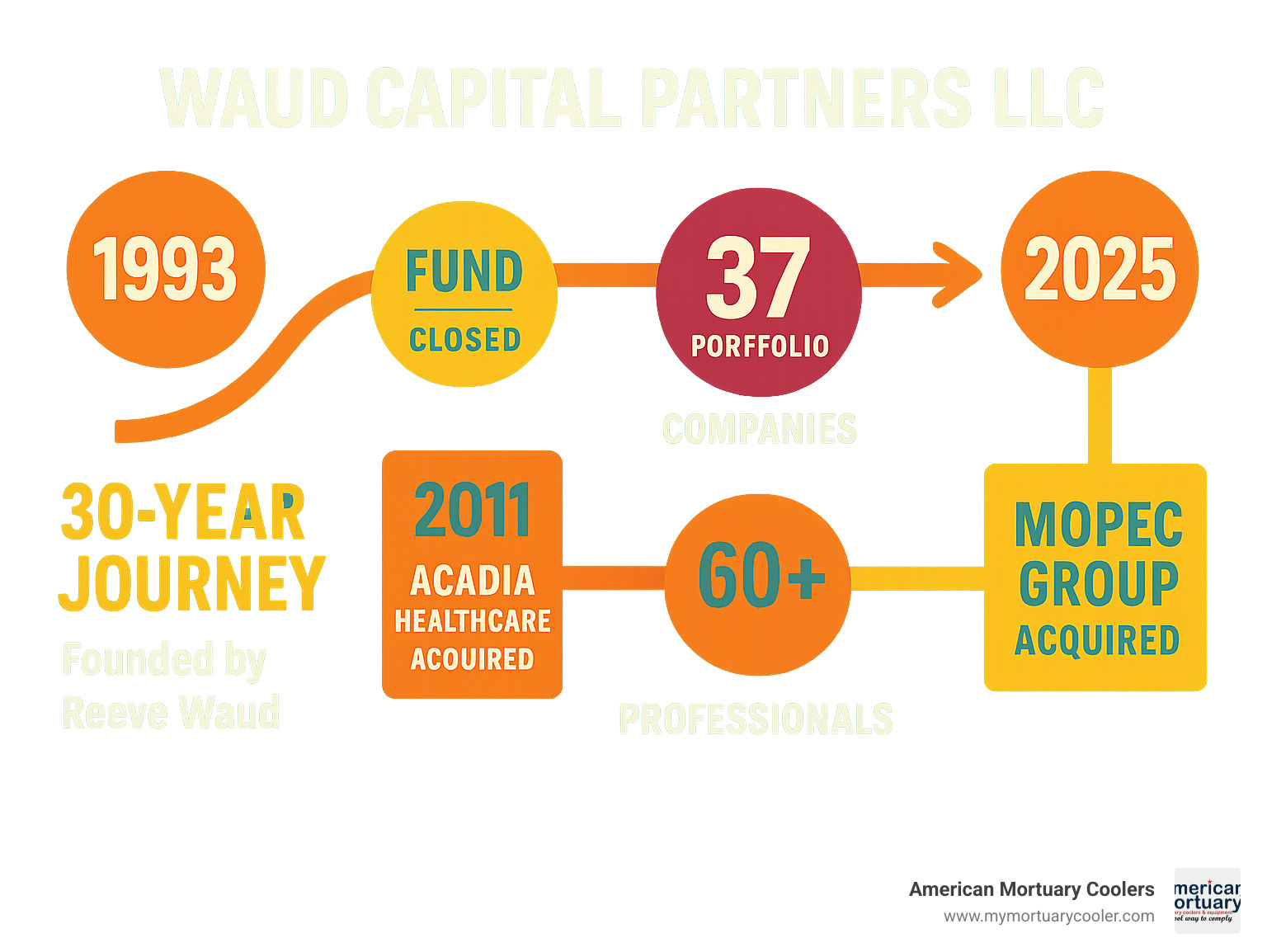

Waud Capital Partners LLC is a Chicago-based private equity firm that has been building market-leading companies since 1993. Founded by Reeve Waud, the firm specializes in healthcare services and software & technology investments, managing $4.6 billion in assets under management as of December 2022.

Quick Facts About Waud Capital Partners LLC:

- Founded: 1993 in Chicago, Illinois

- Assets Under Management: $4.6 billion (as of December 2022)

- Total Investments: 480+ completed investments

- Active Portfolio: 37 companies

- Exits: 43 successful exits

- Average Revenue Growth: 400%+ during hold period

- Team Size: 60+ professionals led by 6 partners

- Investment Focus: Healthcare services, software & technology, tech-enabled healthcare

The firm takes a collaborative approach to investing, combining capital with experienced executive talent to drive sustainable growth. As founder Reeve Waud reflected on the company's 30th anniversary: "The beginning days were far from glamorous, and the future was entirely uncertain..." - yet this uncertainty led to building one of the most respected middle-market private equity firms in the healthcare and technology sectors.

What sets Waud Capital apart is their add-on acquisition strategy - they typically complete 10+ healthcare add-ons and 5+ software add-ons during each investment hold period, creating significant scale and market leadership for their portfolio companies.

As we at American Mortuary Coolers have closely followed Waud Capital Partners LLC's healthcare investments, particularly their recent acquisition of Mopec Group - a leading supplier of anatomic and forensic pathology equipment. This acquisition demonstrates how strategic private equity partnerships can strengthen specialized healthcare equipment companies that serve our industry.

Why This Guide Matters

Understanding Waud Capital Partners LLC is crucial for anyone involved in healthcare services or technology sectors. As a middle-market focused firm, they represent the type of strategic partner that can transform specialized companies through capital infusion, operational expertise, and add-on acquisitions. Their track record of 400%+ average revenue growth during hold periods speaks to their ability to create meaningful value for both investors and the companies they partner with.

For companies in the mortuary and funeral services industry like ours, Waud Capital's recent moves into pathology equipment through Mopec Group signal potential opportunities for strategic partnerships and industry consolidation. Their collaborative approach and long-term relationship focus align well with the values we see in successful healthcare equipment companies.

Waud Capital Partners LLC: History & Leadership

When Reeve Waud founded Waud Capital Partners LLC in 1993, he probably never imagined his Chicago-based startup would grow into a $4.6 billion powerhouse. But that's exactly what happened over three decades of careful relationship building and smart investing.

The change from a one-person operation to a team of 60+ professionals tells a story of steady, thoughtful growth. Reeve's reflection on the firm's 30th anniversary captures this journey perfectly: "The beginning days were far from glamorous, and the future was entirely uncertain." Yet he added, "I don't think I've ever been as excited for the future as I am now."

Today's leadership structure reflects this evolution. Six partners with an average of 25 years of industry experience each guide the firm's strategic direction. This depth of experience shows in every deal they make and every company they partner with.

What makes their leadership approach unique is the collaborative culture they've built. Rather than operating as individual dealmakers, the team works together across investments, sharing knowledge and resources. This approach has proven especially valuable in specialized sectors like healthcare equipment - something we've observed closely through their recent Mopec Group acquisition.

Founding Story

The bootstrap beginnings of Waud Capital Partners LLC mirror many successful American business stories - start small, work hard, and focus on building real value. Reeve Waud didn't have the luxury of massive initial funding or established industry connections. Instead, he built the firm deal by deal, relationship by relationship.

Those early healthcare deals became the foundation for everything that followed. Each investment taught valuable lessons about sector specialization and the power of combining capital with operational expertise. The firm learned early that simply writing checks wasn't enough - they needed to roll up their sleeves and help companies grow.

The first funds were modest by today's standards, but they established the disciplined approach that still guides the firm. Every dollar had to work hard, every relationship had to count, and every investment had to create real value for all parties involved.

Current Leadership Team

The partners roster at Waud Capital today reflects both continuity and evolution. The six-partner structure ensures decisions get made efficiently while maintaining the collaborative culture that's defined the firm since its early days.

Beyond the core partners, the firm's executive partners and broader talent network create what they call an "ecosystem of talent." This isn't just industry jargon - it's a practical approach to ensuring every portfolio company gets access to the right expertise at the right time.

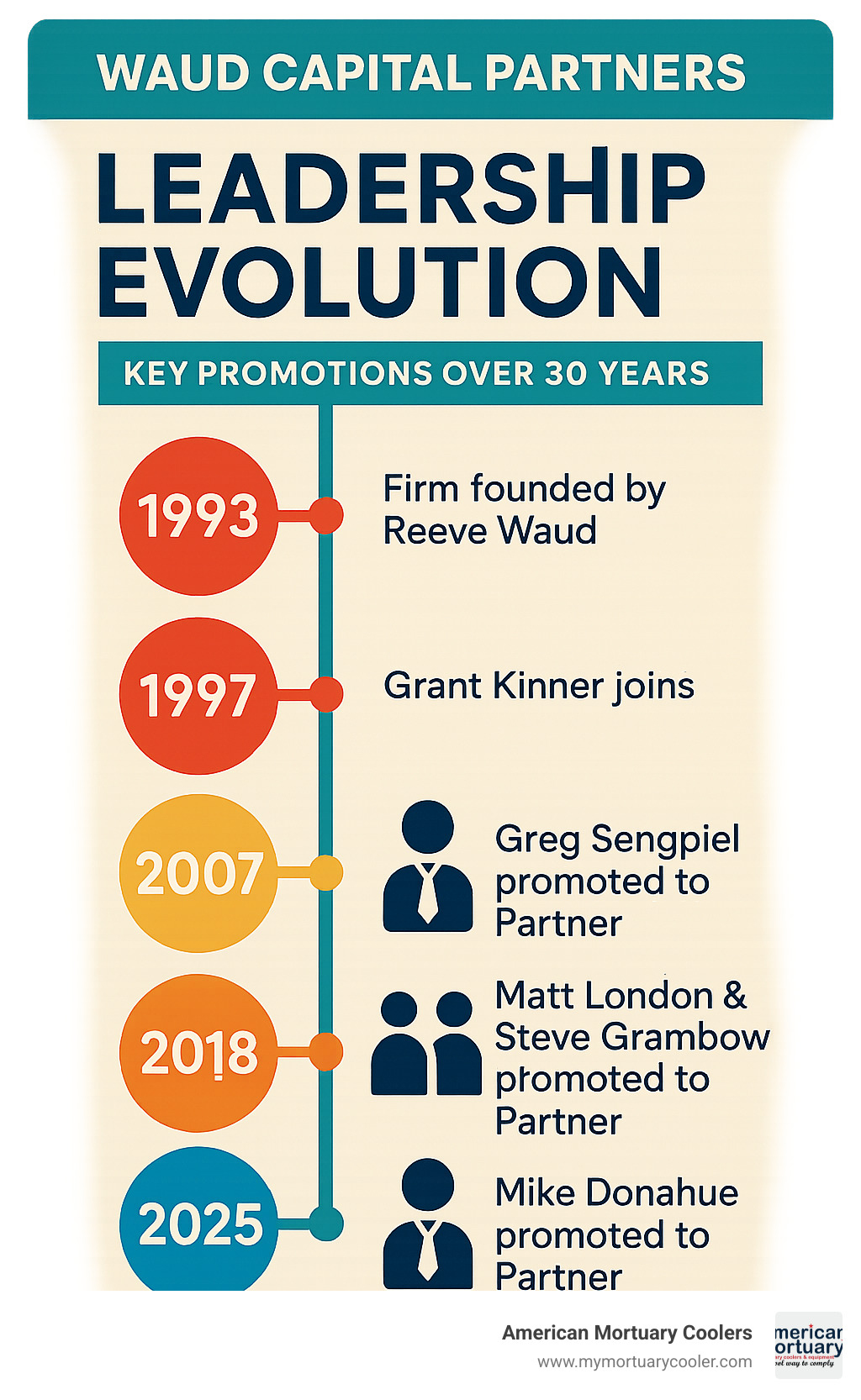

Recent leadership promotions announced during their 30th anniversary celebration show the firm's commitment to developing talent from within. This approach creates stability and ensures the values that built the firm continue to guide its future.

The Chicago headquarters remains the heart of operations, but the firm's influence extends far beyond the Windy City. Their network of industry executives, advisors, and specialists spans the healthcare and technology sectors, creating opportunities for portfolio companies to learn from each other and share best practices.

Investment Focus, Philosophy & Process

Waud Capital Partners LLC keeps things focused with a clear two-sector strategy: healthcare services and software & technology. This isn't about spreading their bets thin - it's about going deep where they know they can win.

The firm's investment philosophy comes down to something they call "collaborative investing by design." Translation? They don't believe in the lone wolf approach that some private equity firms love. Instead, they roll up their sleeves and work alongside management teams to build something bigger together.

What makes their approach special is the process-driven methodology backed by real human expertise at every step. From the moment they start looking at a deal through the final exit, portfolio companies get dedicated support that goes way beyond just writing checks.

Their responsible investing approach means they're thinking about long-term sustainability, not just quick wins. This fits perfectly with industries like ours in mortuary equipment, where relationships and trust matter more than flashy quarterly results.

Sector Specialization

In healthcare services, Waud Capital looks for companies that actually improve patient outcomes while making the system work better. Their crown jewel success story? Acadia Healthcare - they built it into the country's leading behavioral health provider with 576 facilities across 39 states, the U.K., and Puerto Rico.

Behavioral health remains a key focus area, along with other healthcare services that solve real problems for providers and patients alike.

On the software & technology side, they target vertical software solutions and integrated payments platforms. They're especially interested in companies with recurring revenue models that serve mission-critical functions - the kind of software that customers can't live without.

The recent Mopec Group acquisition shows how smart this dual focus can be. Mopec provides specialized pathology equipment that bridges healthcare services with technology solutions, creating exactly the kind of integrated platform that Waud Capital Partners LLC excels at building.

Investment Approach & Sourcing

Here's where things get interesting. Most private equity firms talk about add-on acquisitions, but Waud Capital actually delivers on it. They average 10+ healthcare add-ons and 5+ software add-ons during each investment period. That's not just impressive - it's a completely different level of execution.

This aggressive add-on strategy is a big reason why their portfolio companies see over 400% average revenue growth during ownership. It's not just organic growth - they're actively building market-leading platforms through strategic acquisitions.

Their thematic sourcing approach means they're not just waiting for deals to come to them. The team spends serious time building relationships with management teams, industry executives, and deal sources in their target sectors. This relationship-first approach often gives them access to the best deals before they hit the broader market.

The due diligence process is thorough but practical. They understand that in healthcare and technology, you need to move fast when the right opportunity comes along.

How does Waud Capital Partners LLC support its portfolio companies?

The support doesn't stop after the deal closes. Waud Capital Partners LLC maintains a dedicated human-capital team that works directly with portfolio companies on C-suite recruitment and organizational development. When you need a new CEO or CFO, they don't just hand you a list of recruiters - they tap into their own network of proven executives.

Their annual Cybersecurity Summit brings together portfolio company leaders to tackle shared challenges. Cyber threats are real for everyone from software companies to healthcare equipment providers like Mopec.

The firm's executive network creates value that extends far beyond any single investment. Portfolio companies can learn from each other, share resources, and access experienced industry leaders who can serve as advisors or board members.

For specialized companies in sectors like mortuary equipment, this kind of industry-specific support can be game-changing. Understanding the unique needs of funeral homes, pathology labs, and related healthcare facilities requires deep knowledge that Waud Capital's network provides. More info about Mortuary Equipment Marketplace

The talent ecosystem approach means that when challenges arise, portfolio companies have access to people who've solved similar problems before. It's like having a built-in consulting team that actually understands your business.

Portfolio Highlights & Performance

When you look at what Waud Capital Partners LLC has accomplished over three decades, the numbers tell an impressive story. With 37 active companies in their current portfolio and 43 successful exits behind them, they've built a track record that stands out in the private equity world.

But here's what really catches your attention: their portfolio companies achieve an average of 400% revenue growth during Waud Capital's ownership. That's not just good - that's exceptional performance that shows they know how to pick winners and help them grow.

The secret sauce seems to be their approach to building platforms through acquisitions. Take Acadia Healthcare, their most famous success story. They didn't just buy one behavioral health facility and call it a day. Instead, they completed 48 additional acquisitions between 2005 and 2017, turning Acadia into the country's leading behavioral health provider with 576 facilities across 39 states, the U.K., and Puerto Rico.

This strategy of combining steady organic growth with smart acquisitions has become the Waud Capital playbook. It's how they've consistently delivered results across different market conditions and various healthcare and technology sectors. Get directions to WCP HQ

Notable Active Companies

Looking at their current portfolio, you can see how Waud Capital Partners LLC spreads their expertise across complementary sectors. Altocare represents their healthcare services focus, while Fusion Healthcare and PharmAlliance show their ability to build specialized platforms in niche healthcare markets. On the technology side, TeamSnap serves the youth sports market with software that teams actually depend on.

For those of us in the mortuary equipment business, their recent Mopec Group acquisition is particularly interesting. Mopec supplies anatomic and forensic pathology equipment to pathology labs, hospitals, universities, and morgues. It's a specialized market that requires deep understanding of customer needs - much like our work at American Mortuary Coolers serving funeral homes across the country.

This acquisition shows how Waud Capital identifies companies that serve essential functions in healthcare, even in specialized niches that others might overlook.

Exit Track Record

The firm's exit successes read like a private equity hall of fame. The Acadia Healthcare IPO created substantial value while establishing Acadia as a public company leader. Other notable exits include GI Alliance, iOffice, and Ivy Rehab - each representing successful platform-building strategies in their respective markets.

What's impressive is how they've achieved successful exits across different market conditions. Whether through strategic sales to industry leaders or IPOs for companies that have reached significant scale, they've proven they can create value and find the right exit strategy for each situation.

Growth Metrics

That 400%+ average revenue growth we mentioned earlier doesn't happen by accident. It's the result of their systematic approach to building market leaders through strategic acquisitions and operational improvements.

Their typical playbook involves completing 10+ healthcare add-ons and 5+ software add-ons during each investment hold period. This aggressive acquisition strategy creates scale advantages that competitors struggle to match.

The value creation playbook they've developed emphasizes building market-leading positions through smart acquisitions, operational improvements, and strong management team development. This approach has proven effective across different sectors and market conditions, which explains their strong track record of delivering returns to investors.

For specialized equipment companies like ours, seeing this level of strategic focus and execution provides valuable insights into how private equity partnerships can transform healthcare businesses while maintaining their essential service to customers.

Recent Deals & Differentiators

Waud Capital Partners LLC has been making some pretty impressive moves lately. Their January 2025 acquisition of Mopec Group caught our attention here at American Mortuary Coolers because it shows how smart private equity firms are recognizing the value in specialized healthcare equipment companies.

Mopec isn't just any equipment company - they're a vertically integrated supplier of anatomic and forensic pathology equipment that serves pathology labs, hospitals, universities, and morgues. Sound familiar? It's the same kind of specialized, mission-critical equipment approach we take with our custom mortuary coolers.

The timing makes perfect sense. With precision medicine driving more diagnostic testing and an aging population increasing disease incidence, companies like Mopec are positioned for serious growth. Waud Capital Partners LLC saw this opportunity and moved quickly to build what could become a major consolidation platform in the pathology equipment space.

The firm's financial firepower is impressive too. Their Fund IV closed at $1.056 billion back in February 2016, significantly exceeding their original $750 million target. When investors throw that much extra money at you, it's a pretty strong vote of confidence in your strategy. Kirkland & Ellis on Fund IV closing

Latest Acquisitions 2024-2025

The Mopec Group acquisition represents everything Waud Capital does well. Founded in 1992, Mopec has spent over 30 years building relationships in the pathology equipment market - much like how we've built our reputation in mortuary cooling equipment. They offer the complete package: equipment, consumables, and ongoing service support.

What's particularly smart about this deal is that Mopec serves multiple end markets. They're not just selling to one type of customer - they're supporting pathology labs, hospitals, universities, and morgues. This diversification provides stability while still maintaining deep expertise in pathology equipment.

The firm has also been active with MedTec partnerships and Spectrum collaborations, showing they're not slowing down their platform-building approach. These investments demonstrate their continued confidence that healthcare services and mission-critical software offer some of the best growth opportunities in today's market.

What makes Waud Capital Partners LLC different from other PE firms?

After following Waud Capital Partners LLC for years, several things make them stand out from the typical private equity crowd. Their sector focus is laser-sharp - they're not trying to be everything to everyone. Instead, they've spent 30+ years becoming the go-to experts in healthcare and software investments.

Their add-on acquisition strategy is honestly pretty remarkable. Most private equity firms might do a couple of add-on deals during their ownership period. Waud Capital averages 10+ healthcare add-ons and 5+ software add-ons for each platform company. That's not just buying companies - that's systematically building market leaders.

The talent ecosystem approach they've built reminds us of how the best funeral industry suppliers operate. It's not just about selling equipment - it's about providing ongoing support, sharing industry knowledge, and connecting customers with resources they need to succeed. Waud Capital has created this same type of collaborative network for their portfolio companies.

Their 30-year track record speaks for itself, but what we find most impressive is their commitment to responsible investing. They've published their first annual Responsible Investing Report, showing they're thinking about long-term sustainability, not just quick profits. In industries like ours where relationships matter and reputation is everything, this approach makes perfect sense.

The compliance culture they've built also sets them apart. In healthcare and technology, regulatory compliance isn't optional - it's essential. Having a private equity partner that understands this from day one can make the difference between success and expensive mistakes.

Frequently Asked Questions about Waud Capital Partners

People often ask us about Waud Capital Partners LLC since their recent acquisition of Mopec Group caught our attention in the mortuary equipment industry. Here are the most common questions we hear, along with straightforward answers based on publicly available information.

What is Waud Capital Partners' AUM and how many investments have they completed?

As of December 31, 2022, Waud Capital Partners LLC manages $4.6 billion in assets under management. That's a substantial amount that reflects three decades of steady growth since Reeve Waud started the firm in 1993.

The numbers tell an impressive story of activity and success. Since founding, they've completed more than 480 investments across their healthcare and technology focus areas. This includes both platform companies (the main investments) and add-on acquisitions (smaller companies they buy to strengthen their platforms).

Their track record shows 43 successful exits while currently managing an active portfolio of 37 companies. What's particularly noteworthy is how they've maintained this level of activity consistently over 30 years, which speaks to their disciplined approach and strong relationships in their target sectors.

Where is Waud Capital Partners headquartered and who founded it?

Waud Capital Partners LLC calls Chicago home, with their headquarters located at 300 N. LaSalle Street. The firm was founded in 1993 by Reeve Waud, who continues to lead the organization today - a testament to the stability and long-term vision that has guided the firm through multiple market cycles.

Chicago provides an ideal location for their focus on healthcare and technology investments. The city offers access to the Midwest's strong healthcare sector while maintaining proximity to major institutional investors on both coasts. For a firm that values long-term relationships, being centrally located helps them stay connected with portfolio companies, investors, and industry partners across the country.

The choice to remain in Chicago rather than relocate to traditional private equity centers like New York or California reflects the firm's practical, relationship-focused approach to business.

How does WCP integrate responsible investing into its strategy?

Waud Capital Partners has taken a formal approach to responsible investing, publishing their first annual Responsible Investing Report to demonstrate their commitment to ESG (Environmental, Social, and Governance) principles. This isn't just paperwork - they integrate these considerations throughout their entire investment process.

From the initial due diligence phase through daily portfolio company operations and eventual exit planning, they consider the broader impact of their investments. They look at how companies treat employees, serve communities, and operate sustainably over the long term.

One practical example is their annual Cyber Security Summit, where they bring together portfolio company leaders to address governance and risk management challenges. This type of proactive support helps companies build stronger compliance cultures and better protect themselves and their customers.

Their responsible investing approach aligns perfectly with their 30-year track record of building lasting partnerships. When you're planning to work with management teams for multiple years, it makes sense to ensure everyone is committed to doing business the right way. This long-term perspective has served them well in building trust with both investors and the companies they partner with.

Conclusion

After three decades of building partnerships and growing companies, Waud Capital Partners LLC stands as a prime example of what focused private equity can achieve. Their journey from Reeve Waud's one-person operation in 1993 to managing $4.6 billion today shows how staying true to your strengths - in their case, healthcare and technology - can create lasting value.

What strikes us most about Waud Capital's approach is their partnership ethos. They don't just write checks and walk away. Instead, they roll up their sleeves and work alongside management teams to build something bigger. Their track record of 400% average revenue growth speaks to this hands-on commitment.

The recent Mopec Group acquisition particularly caught our attention here at American Mortuary Coolers. Seeing a respected private equity firm invest in specialized pathology equipment shows the strength of niche healthcare markets. Like us, Mopec serves a specific need with custom solutions - they just happen to focus on pathology labs while we craft mortuary coolers for funeral homes.

Their sustainable growth philosophy aligns with what we've learned in our own business. Building lasting relationships with customers, investing in quality equipment, and understanding your market inside and out - these fundamentals matter whether you're managing billions in private equity or building custom coolers in Tennessee.

Waud Capital Partners LLC proves that staying focused on what you do best, treating people right, and thinking long-term creates value that lasts. Their next 30 years will likely bring even more innovation as healthcare continues evolving and technology transforms how we serve our communities.

For companies like ours in specialized healthcare equipment, their success story offers hope and inspiration. There's room for focused players who understand their customers and deliver reliable solutions.

For more information about custom mortuary solutions and how we serve the funeral industry, visit us at mymortuarycooler.com.