Why Smart Financing Makes Walk-In Coolers Affordable for Any Business

Walk in cooler financing allows businesses to acquire essential refrigeration equipment through loans or leases, spreading costs over 12-84 months instead of paying the full amount upfront. Here's what you need to know:

Key Walk-In Cooler Financing Options:

- Equipment Loans - Own the unit immediately, terms 24-84 months

- Fair Market Value Leases - Lower payments, upgrade flexibility

- $1 Buyout Leases - Rent-to-own with ownership certainty

- 100% Financing - Zero down payment options available

- Credit Flexibility - 91% approval rate, even with imperfect credit

Quick Facts:

- Credit decisions within 24 hours

- Funding available in 2 business days

- Section 179 tax deduction up to $1 million

- Terms from 12-84 months available

- Both new and used equipment eligible

Whether you're a funeral home director managing tight budgets or a restaurant owner preserving working capital, financing transforms a major equipment purchase into manageable monthly payments. The numbers speak for themselves - 91% of submitted applications for walk-in cooler equipment financing are approved, with credit decisions made within 24 hours and funding potentially occurring within 2 business days.

I'm Mortuary Cooler, a national-level mortuary cooler supplier specializing in custom refrigeration solutions for funeral homes and healthcare facilities. Through years of helping funeral directors steer walk in cooler financing options, I've seen how the right financing strategy can transform operations while preserving precious working capital.

Quick look at walk in cooler financing:

How Walk-In Cooler Financing Works: From Application to Install

Getting your hands on walk in cooler financing doesn't have to feel like navigating a maze. The whole process moves surprisingly fast these days. You'll submit your application, get a credit decision within 24 hours, complete your paperwork electronically, and often have funding within 2 business days.

Whether you're weighing a loan versus a lease, dealing with less-than-perfect credit, or just want to understand what documents you'll need, the key is working with lenders who understand the funeral industry's unique needs and timeline pressures.

More info about smart financing

What Is Walk-In Cooler Financing?

Think of walk in cooler financing as a specialized way to pay for your refrigeration equipment over time instead of writing one big check upfront. The cooler itself becomes the collateral, which means you're not putting your entire business at risk like you might with other types of loans.

You'll choose between two main paths: an equipment loan where you own the cooler from day one, or an equipment lease where you either buy it for $1 at the end or have the option to purchase at fair market value.

Walk-In Cooler Financing Eligibility Checklist

Most lenders want to see that you've been in business for at least 2 years, though some specialists work with newer operations. Your annual revenue typically needs to exceed $100,000, and you'll likely need to provide a personal guarantee.

Credit scores of 600 or higher generally open up the best terms, but here's the encouraging news: 91% of applications get approved. Even if your credit isn't perfect, alternative lenders specialize in working with businesses that have faced financial challenges.

You'll need recent financial statements, tax returns, and bank statements. Many lenders will also finance soft costs like delivery, installation, site preparation, and permits as part of your total financing package.

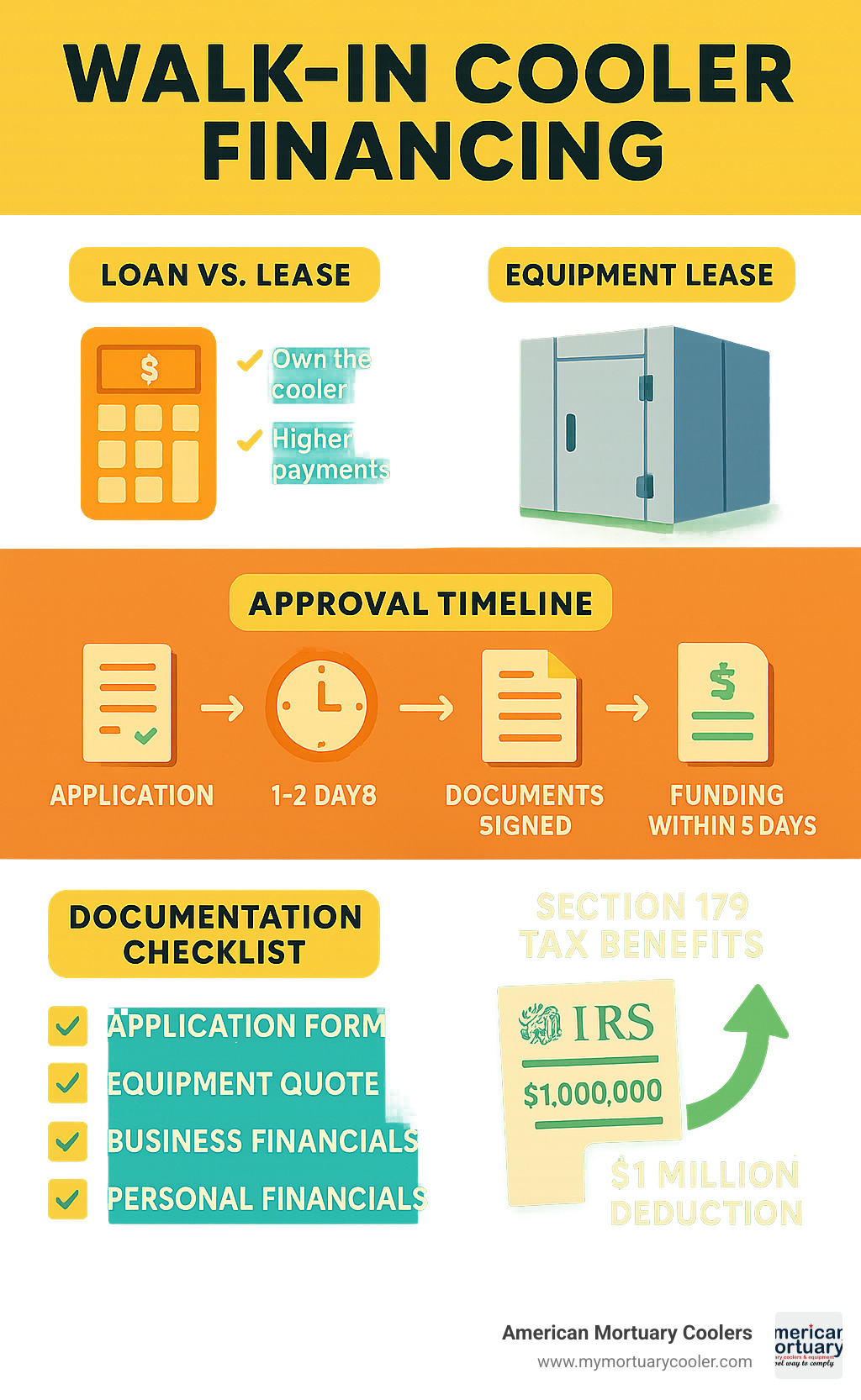

Walk-In Cooler Financing Approval Timeline

The approval process has become remarkably streamlined thanks to electronic documentation and automated underwriting systems. On day one, you'll submit your application with basic business and equipment information using e-signature platforms.

Within 24 hours, you'll typically receive a credit decision. Days two and three involve finishing up documentation electronically, and by days three to five, you'll have funding and can coordinate equipment ordering and delivery.

Walk-In Cooler Financing Options Compared

When you're shopping for walk in cooler financing, you've got several paths to choose from. Each option has its own personality - some focus on ownership, others on flexibility, and some on keeping those monthly payments as low as possible.

The sweet spot depends on your business situation. Are you a new funeral home watching every dollar? A growing operation planning to expand? Or an established business that wants to own everything outright?

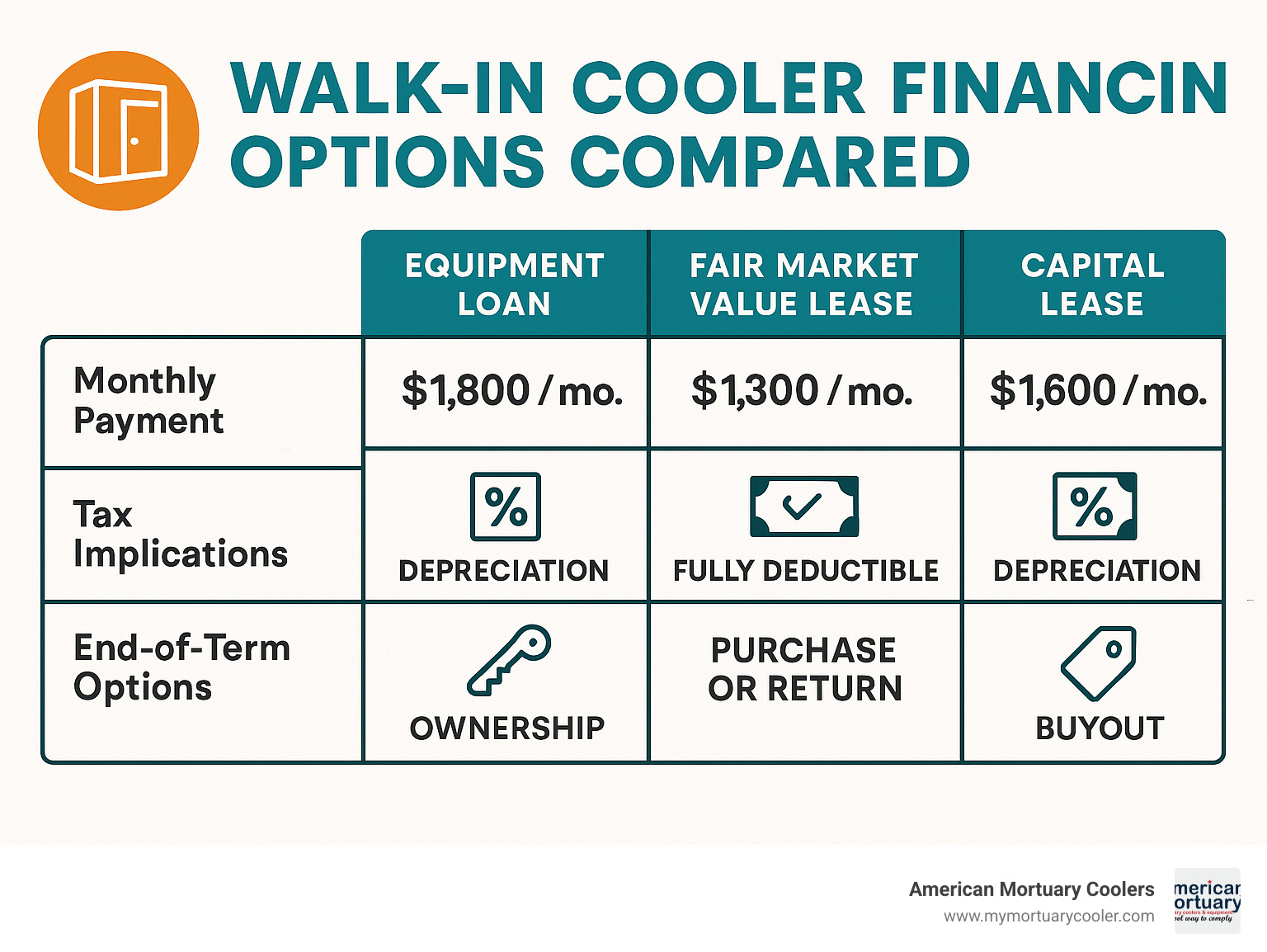

Traditional Equipment Loan

An equipment loan is the most straightforward approach - you borrow money, buy the cooler, and own it from day one. Your walk-in cooler becomes collateral for the loan, which usually means better interest rates than you'd get with an unsecured business loan.

This route works well when you want full ownership immediately and don't mind higher monthly payments. You're building equity with every payment, and you can modify the equipment however you want.

The monthly payments will be higher compared to leasing options, but you'll likely pay less overall. Look for equipment lenders who only put a lien on the cooler itself, not all your business assets.

Fair Market Value Lease

If you want the lowest possible monthly payments, a Fair Market Value lease is your friend. You're essentially renting the cooler with the option to buy it later at whatever it's worth at that time.

This approach gives you incredible flexibility at the end of the lease term. You can buy the cooler (usually for 10-20% of what you originally paid), return it and upgrade to a newer model, or extend the lease month-to-month.

Many funeral directors love this option because it preserves cash flow and credit lines for other business needs. The payments often qualify as operating expenses for tax purposes too.

$1 Buyout / Capital Lease

Think of a $1 buyout lease as a rent-to-own agreement. You make monthly payments over the lease term, then pay one dollar at the end to own the cooler outright.

This option splits the difference between loans and FMV leases. Your monthly payments are higher than FMV leases but lower than equipment loans. You get ownership certainty without the surprise of not knowing what the buyout price will be.

For tax purposes, you might be able to deduct the full lease payment as an operating expense. Many funeral homes choose this route because they want ownership certainty but appreciate the potential tax benefits.

100% Walk-In Cooler Financing for New & Used Units

Zero-down financing is often available for both new and used walk-in coolers. Your approval depends on your credit strength and the equipment you're financing, but many businesses can get started without any upfront cash.

New equipment is the easiest to finance at 100%. Most lenders will cover the full cost of the cooler plus soft costs like delivery and installation.

Used equipment opens up more budget-friendly options, though lenders are pickier about age and condition. Most will finance equipment up to 10 years old.

The beauty of 100% financing is that it preserves your working capital for other business needs. Instead of writing a big check upfront, you can spread the cost over 12-84 months.

Maximizing Benefits: Cash Flow, Taxes & Working Capital

Smart walk in cooler financing does more than just spread out equipment costs over time. When done right, it becomes a powerful business tool that keeps cash in your pocket, delivers tax benefits, and gives you the flexibility to grow your operation.

Every dollar you don't spend upfront on equipment is a dollar you can use for unexpected opportunities. Scientific research on refrigeration efficiency shows that newer walk-in coolers can slash your energy bills by 20-30% compared to older units. Those savings help offset your financing payments while you enjoy better equipment performance.

More info about walk-in cooler installation cost

Preserving Working Capital & Credit Lines

Here's where walk in cooler financing really shines. Instead of writing one big check that drains your bank account, you keep that cash available for the day-to-day needs that keep your doors open.

Your working capital stays intact for payroll, inventory, unexpected repairs, or that growth opportunity you've been waiting for. Meanwhile, your business credit lines remain untouched and ready for when you really need them.

This means predictable monthly expenses that make budgeting easier, while your cash reserves stay ready for whatever comes next. This strategy proves especially valuable for funeral homes where call volume can vary dramatically from month to month.

Section 179 & Bonus Depreciation for Walk-In Coolers

The tax benefits of financing can be substantial. Section 179 of the United States Internal Revenue Code allows businesses to write off the entire purchase price of qualifying equipment, including walk-in coolers, up to $1,000,000 per year with a spending cap of $2,500,000.

That's right - you can potentially deduct the full cost of your walk-in cooler in the same year you put it into service. The current rules allow for a $1 million maximum deduction annually, with the phase-out not beginning until you've spent $2.5 million on qualifying equipment.

Bonus depreciation sweetens the deal even further, allowing 100% first-year deduction for qualifying equipment. Both purchased and leased walk-in coolers may qualify for these benefits, though the specific tax treatment varies depending on your financing structure.

Aligning Payments with Seasonal Cash Flow

Not every business has the same cash flow every month, and smart lenders understand this reality. Progressive lenders offer step-up payment schedules where you start with lower payments that increase over time as your business grows. Seasonal payment structures let you pay more during your busy months and less during slower periods.

These flexible structures work particularly well for hospitality businesses that see summer rushes, seasonal operations with clear busy periods, and funeral homes where monthly activity can vary significantly.

Choosing a Financing Partner & Avoiding Mistakes

Finding the right financing partner for your walk in cooler financing can make the difference between a smooth transaction and years of frustration. With 91% of submitted applications for walk-in cooler equipment financing being approved, the real challenge isn't getting approved - it's securing terms that actually support your business goals.

More info about all about financing options

Key Factors When Comparing Lenders

Interest rates grab attention first, but they don't tell the whole story. A lender offering 8% with flexible terms might serve you better than one charging 6% with rigid requirements. Focus on how the monthly payment impacts your cash flow.

Term flexibility matters more than most people realize. Lenders offering terms from 12-84 months give you room to optimize your monthly payments. Need lower payments? Stretch the term. Want to pay off quickly? Choose a shorter period.

Service reputation separates good lenders from great ones. Equipment financing relationships often span multiple years, and you want a partner who answers calls and solves problems. Check references and online reviews.

Industry experience makes everything smoother. Lenders familiar with funeral homes understand your seasonal patterns, equipment values, and operational requirements.

Common Mistakes in Walk-In Cooler Financing

The biggest mistake I see is ignoring soft costs like delivery, installation, site preparation, and permits. These expenses can add 15-25% to your equipment cost. If your financing only covers the cooler itself, you'll face an unwelcome cash surprise.

Fair Market Value lease confusion trips up many buyers. These leases require a purchase payment at the end - typically 10-20% of the original cost. Budget for this expense or have a clear upgrade strategy.

Balloon payment traps lurk in some financing structures. These arrangements feature low monthly payments followed by a large final payment. Make sure you understand every payment obligation before signing anything.

Overlooking prepayment flexibility can cost you later. Most quality lenders allow prepayment after 12 months, but confirm this upfront.

Special Programs for Restaurants, Hospitality & Healthcare

Smart lenders recognize that different industries have unique needs, creating specialized programs that work better than one-size-fits-all approaches.

Restaurant programs often bundle multiple equipment purchases into single transactions, offer seasonal payment options, and provide rapid approval for emergency replacements.

Healthcare and mortuary programs feature extended terms for essential equipment, compliance financing for regulatory requirements, and specialized underwriting that understands professional practices.

Energy efficiency programs deserve attention because some lenders offer reduced rates for high-efficiency equipment qualifying for utility rebates or tax credits.

Financing Custom & Large Walk-In Cooler Installations

When you're looking at a custom mortuary cooler or a large installation project, walk in cooler financing becomes more complex - but also more important. These aren't your standard off-the-shelf units, and the financing needs to be just as customized as the equipment itself.

The challenge with large installations isn't just the equipment cost - it's everything else that goes with it. Freight costs for shipping a custom unit. Crane rental to get it positioned exactly right. Electrical work to handle the power requirements. These "soft costs" can easily add 20-30% to your total project budget.

That's where smart financing partners make the difference. They understand that financing just the cooler itself leaves you scrambling to cover thousands in additional costs.

Bundling Soft Costs Into Your Walk-In Cooler Financing

The best walk in cooler financing programs will cover way more than just the cooler itself. We're talking about a complete project financing approach that eliminates those surprise cash requirements.

Site preparation often catches people off guard. Your new custom cooler might need a reinforced concrete pad, upgraded electrical service, or even structural modifications to your building. These aren't small expenses - we've seen site prep costs run anywhere from $3,000 to $15,000.

Delivery and installation for custom units requires specialized transport and professional installation teams. When you're dealing with a unit that weighs several thousand pounds and needs to fit through a specific doorway with millimeter precision, this isn't a job for your local handyman.

Extended warranties and service contracts make sense for custom equipment that's critical to your operations. Permits and inspections vary by location, but health department approvals and local compliance requirements are non-negotiable.

Progressive lenders bundle all these costs into your financing package. Instead of writing multiple checks throughout the project, you get one monthly payment that covers everything.

More info about walk-in cooler options

Case Study: American Mortuary Coolers Client Upgrade

A funeral home in Georgia perfectly illustrates how custom walk in cooler financing should work. They'd been operating with a 20-year-old cooler that was constantly breaking down.

They needed a custom mortuary cooler that would fit their unique space constraints, handle their specific capacity requirements, and leave them with enough working capital to complete other facility renovations.

The total project came to $45,000, including the custom cooler, specialized installation, electrical upgrades, and a comprehensive service warranty. We worked with them to structure a 60-month capital lease that solved multiple problems at once. The monthly payments came in under $900 - less than they were spending on emergency repairs and energy costs with their old unit.

They qualified for immediate Section 179 tax benefits on the full $45,000, which effectively reduced their first-year cost by $15,000. They kept that $45,000 in working capital available for their other facility improvements. Six months later, they were able to renovate their family consultation rooms and upgrade their chapel sound system.

The new energy-efficient cooler also reduced their monthly utility costs by about $200, which helps offset the financing payment. That's the power of smart custom equipment financing.

Frequently Asked Questions about Walk-In Cooler Financing

Let's tackle the questions we hear most often from funeral home directors and business owners exploring walk in cooler financing.

Is 100% financing or $0 down really possible?

Yes, 100% financing or $0 down options are genuinely available for walk-in cooler equipment, though it's not automatic for everyone. I've seen plenty of funeral homes and restaurants secure complete financing packages, but approval hinges on a few key factors.

Your credit strength plays the biggest role here. Businesses with credit scores of 650 or higher typically sail through zero-down approvals. But even if your credit isn't perfect, don't give up hope - many lenders work with scores as low as 600.

Equipment age matters too. Brand new walk-in coolers almost always qualify for 100% financing because they hold their value well and serve as solid collateral. Used equipment can still qualify, though some lenders might ask for a small down payment.

Business stability rounds out the picture. If you've been operating for at least two years with steady revenue, lenders view you as a safer bet.

Can I qualify with less-than-perfect credit?

Absolutely, and here's why I'm confident saying that: 91% of applications get approved, and that includes plenty of businesses dealing with credit bumps in the road.

I've worked with funeral home directors who worried their credit would disqualify them, only to find that alternative lenders focus more on current cash flow than past credit hiccups. Credit scores below 600 don't automatically close doors - they just mean you might pay slightly higher rates.

Recent credit issues like late payments or collections don't necessarily kill your chances either. Lenders understand that businesses go through rough patches. They're more interested in whether you can handle the monthly payments going forward.

The key is working with lenders who specialize in equipment financing rather than traditional banks that might be more rigid about credit requirements.

What happens at the end of the lease or loan term?

Equipment loans are the simplest - after your final payment, you own the walk-in cooler outright. No surprises, no additional costs, no paperwork.

Capital leases with $1 buyouts work almost the same way. You pay your regular monthly payments throughout the term, then pay one final dollar and receive clear title to the equipment.

Fair Market Value leases give you three choices when the term ends. You can purchase the equipment at its current fair market value (typically 10-20% of what you originally paid), return it with no further obligation, or upgrade to newer equipment with a fresh lease.

The catch with FMV leases? You need to plan ahead. If you want to keep the equipment, budget for that final purchase payment.

Conclusion

Making the smart choice about walk in cooler financing can transform your business operations in ways that go far beyond just getting new equipment. When you spread that major capital expense into manageable monthly payments, you're preserving the working capital that keeps your business running smoothly during unexpected challenges.

The numbers tell the story: with 91% approval rates and 24-hour credit decisions, financing has become more accessible than ever. Terms from 12-84 months give you the flexibility to structure payments that make sense for your specific situation.

Equipment loans work beautifully when you want immediate ownership and can handle higher payments. Fair market value leases keep monthly costs low while giving you upgrade flexibility. And capital leases provide that perfect middle ground - rent-to-own simplicity with tax advantages.

The key ingredients for success? Compare multiple lenders to find the best fit, include those soft costs like delivery and installation in your financing package, and leverage Section 179 tax benefits that can save you thousands. Most importantly, choose terms that work with your cash flow patterns, not against them.

At American Mortuary Coolers, we understand that funeral homes and healthcare facilities face unique challenges. Your refrigeration needs are critical - there's no room for compromise on quality or reliability. That's why we've built relationships with financing specialists who understand your industry and can structure deals that work for your specific operational requirements.

Our custom mortuary coolers across Tennessee, Georgia, Illinois, and nationwide come with financing options designed around your business needs. We know that every funeral home is different, and your financing should reflect that reality.

More info about mortuary coolers collection

Ready to take the next step? Contact us today to discuss your refrigeration needs and explore your walk in cooler financing options. With our expertise in custom mortuary coolers and established relationships with equipment financing specialists, we'll help you secure the equipment your business needs while keeping your working capital where it belongs - supporting your continued success and growth.