Why American Funeral Finance Is Reshaping the Death Care Industry

American funeral finance has become essential for funeral homes and families dealing with the reality that funeral costs average $7,000-$12,000 while insurance payouts can take weeks or months to arrive. Here's what you need to know:

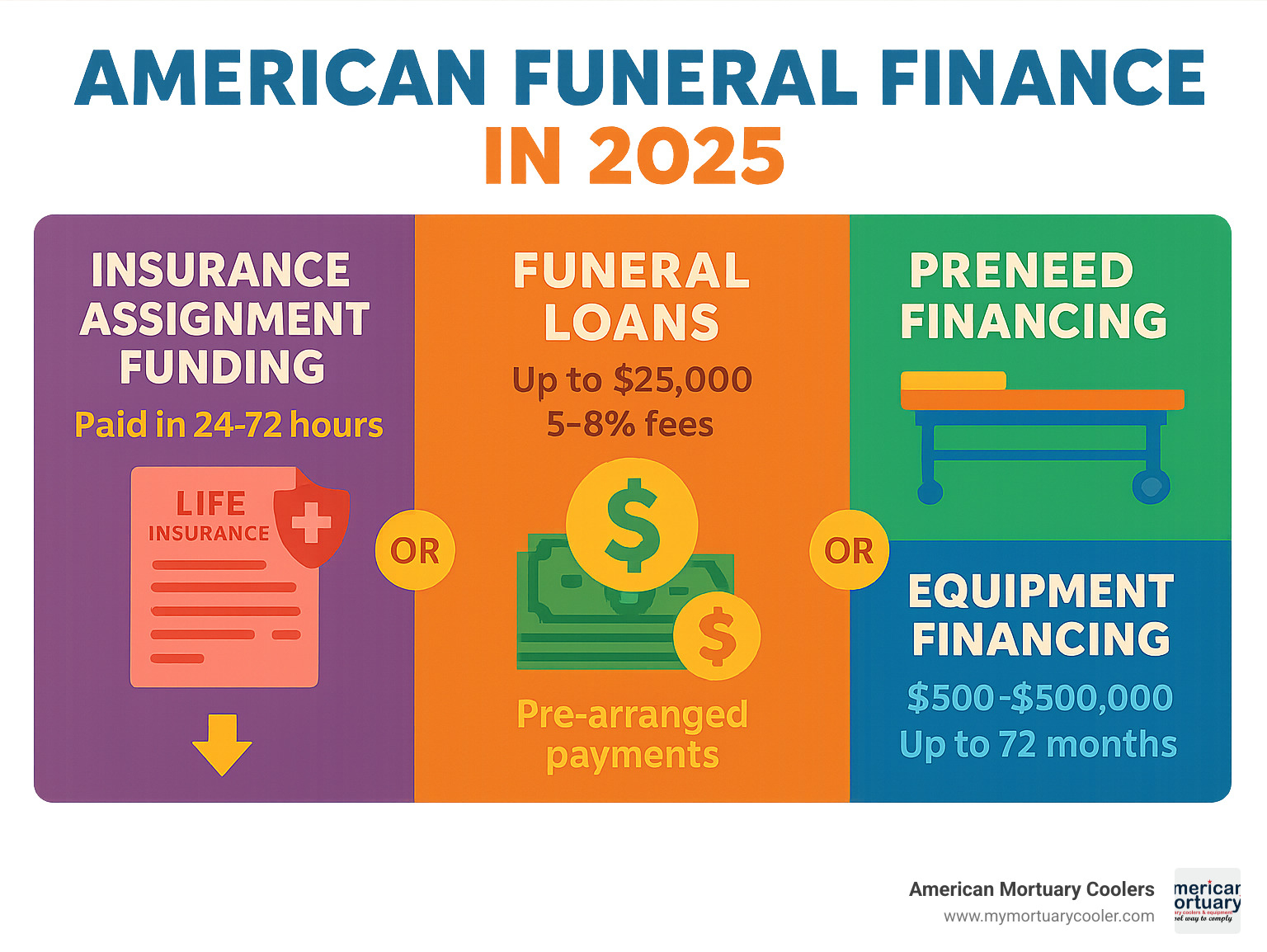

Quick Overview of American Funeral Finance Options:

- Insurance Assignment Funding - Get paid in 24-72 hours vs. 4-6 weeks waiting for insurers

- Funeral Loans - Up to $25,000 with 5-8% origination fees through providers like LendingUSA

- Preneed Financing - Pre-arranged payment plans through companies like Homesteaders Life

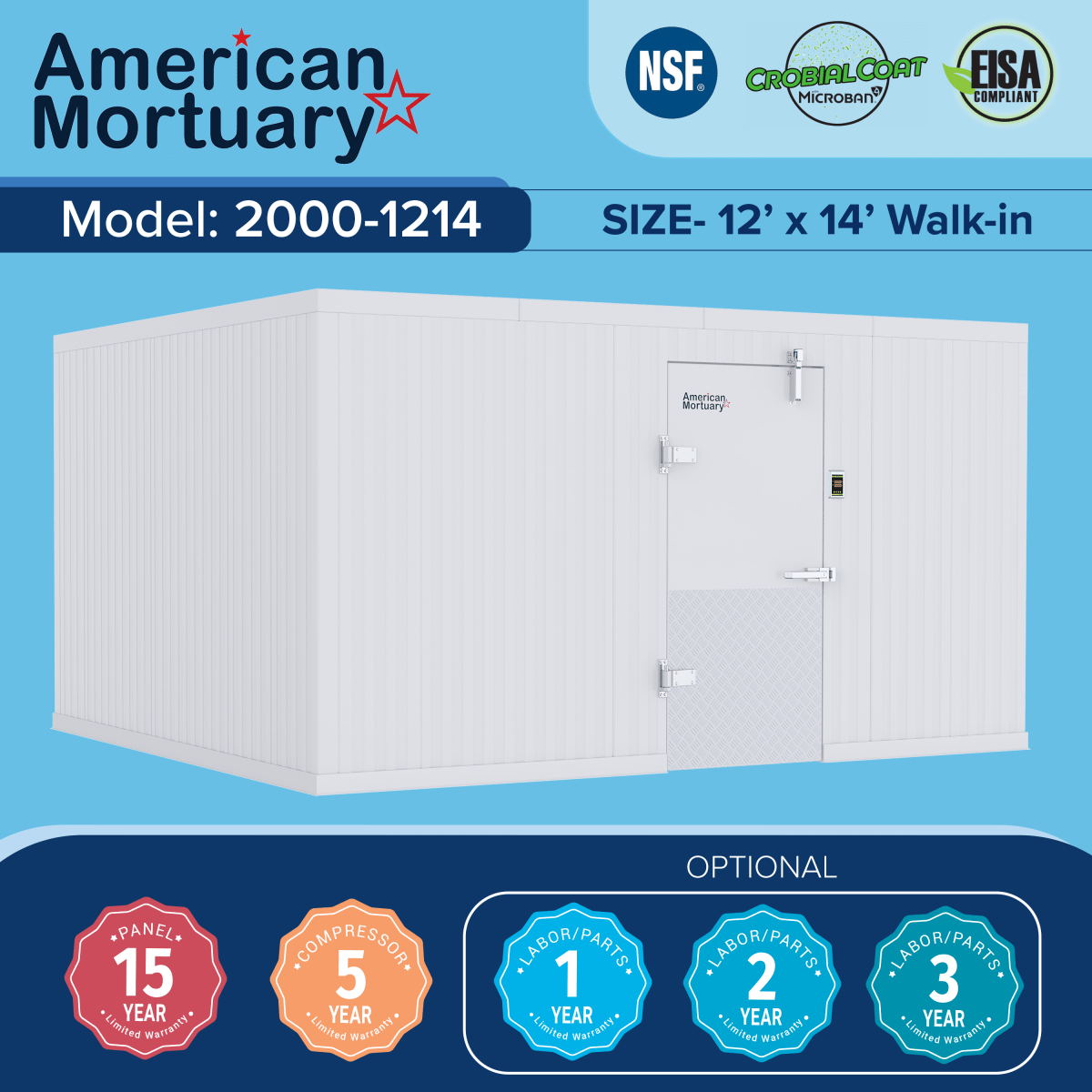

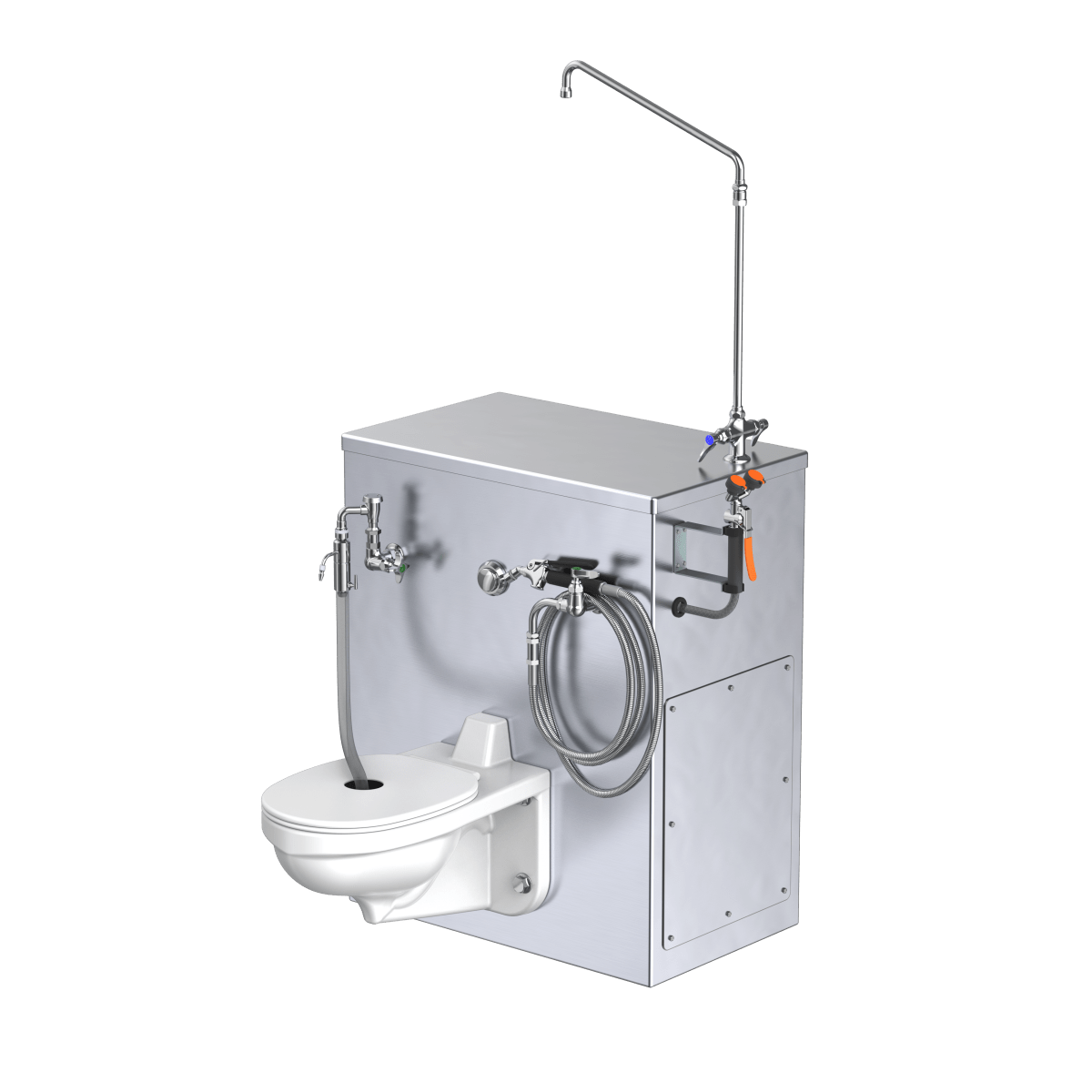

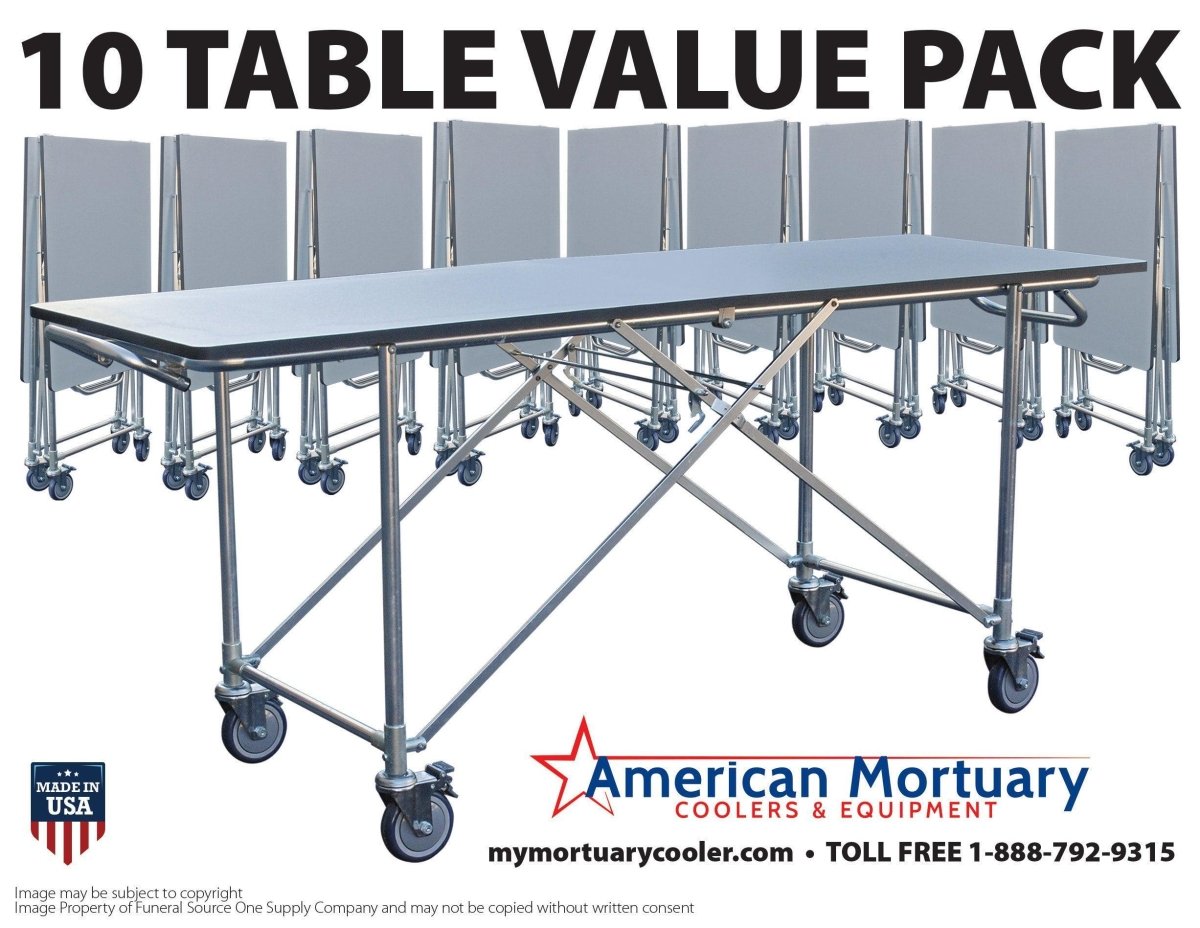

- Equipment Financing - $500-$500,000 for mortuary equipment with up to 72-month terms

The numbers tell the story clearly. Over 2,100 funeral homes nationwide now use assignment funding services, and companies like American Capital Funding typically pay within 72 hours compared to the standard 4-6 week insurance claim process.

This shift matters because funeral homes increasingly require payment upfront while families struggle with unexpected costs during grief. As one industry professional noted: "The cash you have today can have a profound effect on the success of your business tomorrow."

The landscape includes specialized companies like American Funeral Financial, which offers non-recourse insurance assignment funding, and broader lenders adapting to serve the death care industry's unique needs.

I'm Mortuary Cooler, a national-level mortuary cooler supplier who has worked extensively with funeral homes navigating both equipment financing and operational cash flow challenges in american funeral finance. Through years of direct experience with funeral directors, I've seen how smart financing decisions impact both service quality and business sustainability.

American funeral finance vocab to learn:

The Landscape of American Funeral Finance

The american funeral finance industry has grown from a niche service into a cornerstone of modern funeral home operations. It's a direct response to a frustrating reality: funeral costs keep rising while families and funeral homes get caught in an expensive waiting game.

Here's what's happening on the ground. Most funeral homes now require payment upfront - we're talking $7,000 to $12,000 for a typical service. Meanwhile, families are waiting weeks or months for life insurance companies to process claims. That gap creates real hardship for everyone involved.

The market has responded with specialized financial services that didn't exist twenty years ago. Today's american funeral finance landscape includes insurance assignment funding, direct consumer loans, preneed payment plans, and equipment financing for funeral homes themselves. Each serves a different piece of the puzzle, but they all aim to solve the same core problem: getting the right money to the right people at the right time.

The numbers tell the story clearly. According to NFDA data, the average time from claim submission to insurance payout has actually increased over the past decade, while funeral home operating costs continue climbing. Speed-to-funding has become critical, and compliance requirements have made the process even more complex for funeral directors trying to manage it all in-house.

What Is American Funeral Financial?

American Funeral Financial represents companies that specialize in assignment funding - essentially buying the rights to insurance payouts from funeral homes in exchange for immediate cash. Think of it as factoring, but specifically designed for the unique challenges of death care.

The process centers around claim processing that typically delivers 24-hour payment to funeral homes. Instead of waiting weeks for Mutual of Omaha or Northwestern Mutual to cut a check, funeral directors can have funds in their account the next business day.

What makes this particularly valuable is the non-recourse structure. Once the assignment funding company pays the funeral home, they own the risk. If the insurance company later denies the claim or finds a policy lapse, that's not the funeral home's problem anymore. The funeral home keeps the money either way.

This shift has been transformative for smaller funeral homes that couldn't afford to carry large accounts receivable balances while waiting for insurance companies to pay.

How american funeral finance shapes day-to-day operations

Walk into any funeral home using american funeral finance services, and you'll notice the difference immediately. Staff spend less time on the phone with insurance companies and more time with families. The administrative burden that used to consume hours each week gets transferred to companies that specialize in insurance claim management.

Cash flow improvements ripple through every aspect of operations. Funeral homes can pay suppliers on time, meet payroll without stress, and even take advantage of early payment discounts. Instead of juggling credit lines and delaying equipment purchases, they can operate from a position of financial strength.

Bad-debt reduction might be the biggest operational game-changer. Traditional funeral homes often write off 3-5% of revenue from denied insurance claims or family payment defaults. Assignment funding eliminates most of this risk by transferring collection responsibility to companies with specialized expertise and resources.

The administrative efficiency gains are substantial too. Many funeral homes report cutting their accounts receivable management time by 60-70% after switching to assignment funding for insurance cases.

How Insurance Assignment Funding Works

The world of american funeral finance through insurance assignments might seem complicated at first, but it's actually a straightforward process designed to get families the help they need quickly. Think of it as a bridge that connects your insurance benefits to immediate payment when you need it most.

Everything starts with verification - the funding company needs to confirm that the insurance policy exists and is valid. They'll contact the insurance carrier directly to check that the policy is active, find out the death benefit amount, and make sure the person requesting the assignment actually has the legal right to do so. This step protects everyone involved.

The heart of the process is the irrevocable assignment, which sounds scarier than it actually is. This simply means the beneficiary formally gives their rights to the insurance money over to the funeral home or funding company. Once this paperwork is signed and notarized, it can't be undone - that's what makes it "irrevocable."

Policy valuation determines how much money you'll receive upfront. Most funding companies don't advance the full death benefit amount. Instead, they typically provide a percentage of the total benefit, keeping some to cover their fees and protect against potential risks. This is standard practice across the industry.

Throughout this entire process, beneficiary consent remains absolutely crucial. No one can force you into an assignment - you must voluntarily agree to it, and this agreement must be properly documented to protect your rights.

Step-by-Step: From Death Certificate to Deposit

Once you decide to move forward with insurance assignment funding, the actual timeline from paperwork to payment typically runs 24-72 hours when everything goes smoothly. Here's how it unfolds in real life.

Your funeral director will help you complete the necessary forms, which usually include a verification and power of attorney form, the irrevocable assignment form, and a standard life insurance claim form. Many companies now use systems that auto-populate information to reduce errors and speed things up.

The notarization step is non-negotiable - particularly for the assignment forms. You'll need to sign these documents in front of a notary public. This might seem like an extra hassle during a difficult time, but it's actually there to protect you by ensuring the assignment is legally valid.

Modern funding companies make submission easy through secure web portals where documents can be uploaded instantly. Some still accept fax or email, but the online portals are usually faster and more reliable than traditional mail methods.

Once your funding company receives everything, they verify all information directly with the insurance carrier. When everything checks out, they'll send your payment through ACH transfer, wire transfer, or overnight check. ACH transfers are typically the fastest and don't come with additional fees.

How american funeral finance via insurance assignments protects families

American funeral finance through insurance assignments does something really important - it removes the financial pressure during one of life's most difficult moments. Without this option, families often face heartbreaking choices about how to pay for funeral services while they're still processing their grief.

The biggest protection is eliminating out-of-pocket expenses when you're least prepared for them. Instead of scrambling to find thousands of dollars upfront or waiting weeks for insurance companies to process claims, families can move forward with funeral arrangements immediately.

This immediate access also opens up possibilities for additional services that might otherwise be out of reach. Maybe you want to add special memorial items, upgrade to a more meaningful casket, or include ceremony elements that better honor your loved one. When the financial timing isn't a barrier, these choices become possible.

The emotional relief that comes with assignment funding can't be measured in dollars. Grief is already overwhelming without adding the stress of figuring out how to pay for everything. When families know the insurance assignment will handle the costs, they can focus their energy on what really matters - celebrating their loved one's life and supporting each other.

For families looking to balance meaningful services with practical costs, our guide on affordable funeral supplies offers helpful insights for creating dignified services that honor your budget.

Key Advantages & Potential Drawbacks for Funeral Homes and Families

When we look at american funeral finance, it's clear that the benefits are significant, but every financial service comes with both advantages and considerations that deserve careful thought.

The most obvious advantage is fast funding - we're talking about payment in 24-72 hours instead of the typical 4-6 week wait for insurance companies to process claims. This speed difference is genuinely life-changing for funeral homes struggling with cash flow.

Improved liquidity means funeral homes can say "yes" to more families. Instead of having to turn away families who can't pay upfront, funeral directors can serve them knowing that assignment funding will deliver quick payment. This flexibility often makes the difference between a sustainable business and one that's constantly stressed about money.

The administrative benefits are equally important. Lower accounts receivable means less time spent chasing down insurance companies and more time actually serving families. When you consider that staff time costs money, the 3-5% fee structure often pays for itself through reduced administrative overhead.

Risk transfer provides peace of mind that's hard to put a price on. Once the assignment funding goes through, funeral homes typically aren't on the hook if the insurance company later decides to deny the claim. That's a significant weight off your shoulders.

Benefits of american funeral finance for funeral homes & cemeteries

Beyond the obvious cash flow improvements, american funeral finance creates operational advantages that ripple through every aspect of running a funeral business.

Fee-for-service revenue becomes predictable when you're not waiting months for payment. This predictability helps with everything from budgeting to maintaining good relationships with suppliers who appreciate being paid on time.

Staffing efficiency improves dramatically when your administrative team isn't spending hours on insurance claim follow-up. That time can be redirected to activities that actually generate revenue or, more importantly, to providing better service to grieving families.

The competitive edge factor shouldn't be underestimated. When families are comparing funeral homes during one of the most difficult times in their lives, being able to offer flexible payment options often influences their decision.

Possible Downsides & Mitigation Tips

The primary cost consideration is those service fees, which typically run 3-5% of the total benefit amount. While this cost is usually justified by the speed and convenience, it does mean less money available for actual funeral services.

Incomplete paperwork can completely eliminate the speed advantage that makes assignment funding attractive in the first place. The best defense here is thorough staff training on proper form completion and making sure everyone understands the documentation requirements.

Beneficiary disputes occasionally complicate things when multiple parties claim rights to insurance proceeds. These situations can delay or prevent assignment funding until everything gets sorted out through legal channels.

Compliance oversight becomes more complex when working with assignment funding companies. Funeral homes need to make sure they're partnering with reputable companies that follow all applicable regulations - not all funding companies are created equal.

The emotional aspect matters too. Research shows that financial stress significantly impacts the grieving process, which makes proper funeral financing even more critical for family wellbeing. You can learn more about this connection through scientific research on grief financial stress.

Industry Trends, Competitors & Future Outlook

The american funeral finance world is changing fast, and it's exciting to watch new companies shake things up while established players adapt to stay competitive.

LendingUSA has made some impressive moves lately, especially after becoming an NFDA Endorsed Provider. What caught everyone's attention was their bold decision to actually pay funeral homes 101% of the funded loan amount. Yes, you read that right - they're giving funeral homes a 1% profit share while keeping borrower fees reasonable at 5-8%. It's a smart way to build loyalty in a competitive market.

American Capital Funding has been the steady workhorse since 2000, serving over 2,100 funeral homes and cemeteries nationwide. Their bread and butter is non-recourse insurance assignment funding with that coveted 24-72 hour payment timeline. They've basically set the standard that everyone else tries to match.

Then there's Homesteaders Life, which has been around since 1906 - back when horse-drawn hearses were still common! Their specialty is preneed financing, and their century of experience shows. They combine financial solutions with marketing support, which is pretty clever when you think about it.

MemorialFunding.org represents the newer wave of companies going directly to families with monthly payment programs. They're trying to simplify things by covering funeral home, memorial service, and cemetery costs all in one package.

The fintech companies are starting to sniff around this market too, bringing their digital-first approach and promises of lower costs through automation. Whether they'll understand the unique needs of grieving families remains to be seen.

Alternative Funding Providers & How They Compare

C&J Financial and Express Funeral Funding might be smaller players, but they often provide that personal touch that larger companies can't match. If you're a smaller funeral home or dealing with an unusual situation, these companies might be more willing to work with you.

The LendingUSA profit-share model is genuinely for this industry. Instead of charging funeral homes fees like everyone else, they flip the script and actually pay the funeral homes. It's like they looked at the traditional model and said, "What if we did the opposite?"

Homesteaders' preneed focus sets them apart from the pack. While most companies handle crisis situations when families need money immediately, Homesteaders specializes in helping people plan ahead. Their century of experience in advance funeral planning gives them insights that newer companies simply can't match.

For all the latest developments in this space, including more details about LendingUSA's innovative approach, check out the latest NFDA update on LendingUSA.

Technology & Regulatory Trends to Watch

E-signature adoption got a huge boost from COVID-19, and there's no going back. Families appreciated being able to handle paperwork remotely during lockdowns, and funeral homes finded it made everything faster. This trend will likely make assignment funding even more efficient.

State insurance regulations are getting more attention as this industry grows. Some states are implementing stricter oversight of assignment funding practices, which isn't necessarily bad - it should weed out any bad actors and make the whole industry more trustworthy.

Dodd-Frank implications might eventually reach funeral financing as the industry gets bigger and attracts more regulatory eyeballs. The companies that get ahead of compliance requirements now will probably have smoother sailing later.

AI fraud detection is being rolled out by larger funding companies to catch potentially fraudulent insurance policies or assignments. It sounds high-tech and scary, but it should actually make things better by reducing risks and potentially lowering costs.

The growing interest in eco-friendly burials and alternative funeral services is creating new financing challenges. Traditional life insurance policies might not fully cover green burials or innovative memorial options, so financing companies will need to adapt their offerings.

Frequently Asked Questions about American Funeral Finance

How quickly can my funeral home receive payment?

When you're dealing with american funeral finance through insurance assignment funding, speed is usually the biggest advantage. Most companies get payment to funeral homes within 24-72 hours once all the paperwork is complete.

American Capital Funding typically processes payments within 72 hours, while companies like American Funeral Financial often advertise 24-hour funding on assigned accounts. That's a huge difference from the usual 4-6 week wait for insurance companies to pay claims directly.

The secret to getting fast payment is having complete, accurate documentation. When all forms are filled out correctly, signatures are properly notarized, and the insurance policy information checks out, everything moves smoothly. But if there's a missing signature or incomplete paperwork, you might be looking at several extra days of delays.

Your payment method also affects timing. ACH transfers are usually fastest - often same-day or next-day. Wire transfers are quick too but might cost extra fees. Overnight checks take an extra day but work well if you prefer not to deal with electronic payments.

What fees should families expect when using assignment funding?

Here's something that surprises many people: families typically don't write a check for assignment funding fees. Instead, the fees get deducted from the insurance proceeds before the funeral home receives payment.

The standard fee structure runs about 3-5% of the total assignment amount. So if you're working with a $50,000 life insurance policy, the assignment funding fees might be anywhere from $1,500 to $2,500. This means the funeral home would receive $47,500 to $48,500 instead of waiting over a month for the full $50,000 from the insurance company.

Some companies offer better deals based on volume or assignment size. High-volume funeral homes might negotiate lower rates, while smaller assignments could carry higher percentage fees. It's worth shopping around if you do a lot of assignment funding business.

These fees are separate from any other financing charges if families need additional loans beyond what the insurance assignment covers.

Are there credit checks or recourse if the policy is denied?

This is where american funeral finance through assignment funding really shines. Most companies operate on a non-recourse basis, which means no credit checks are required and there's no coming back to the funeral home or family if the insurance company later denies the claim.

The funding company takes on all the risk of insurance claim denial in exchange for their fee. This risk transfer is one of the biggest benefits compared to traditional loans that would require credit checks and personal guarantees from someone.

That said, the funding company doesn't just take anyone's word for it. They verify the insurance policy information before cutting a check. They'll contact the insurance carrier to confirm the policy is active, check the death benefit amount, and look for any obvious red flags that might lead to a claim denial.

If an insurance company does end up denying a claim after assignment funding has been provided, the funeral home keeps the money with no obligation to pay back the funding company. This protection is valuable because insurance claim denials can happen for all sorts of reasons - policy lapses, beneficiary disputes, or other complications that are hard to predict upfront.

Conclusion

American funeral finance has quietly revolutionized how funeral homes operate and how families steer one of life's most challenging moments. What started as a simple solution to cash flow problems has grown into something much more meaningful - a way to remove financial stress during grief.

The change is remarkable when you think about it. Just a few years ago, funeral homes regularly turned away families who couldn't pay upfront, or families went into debt waiting for insurance companies to pay out. Now, with assignment funding providing payment in 24-72 hours instead of weeks, both funeral homes and families have the cash-flow freedom they need.

The numbers speak for themselves: faster funding, reduced administrative headaches, improved cash flow, and risk transfer away from funeral homes. Yes, the 3-5% fees might seem steep at first glance, but most funeral directors tell us it's worth every penny for the peace of mind and operational simplicity.

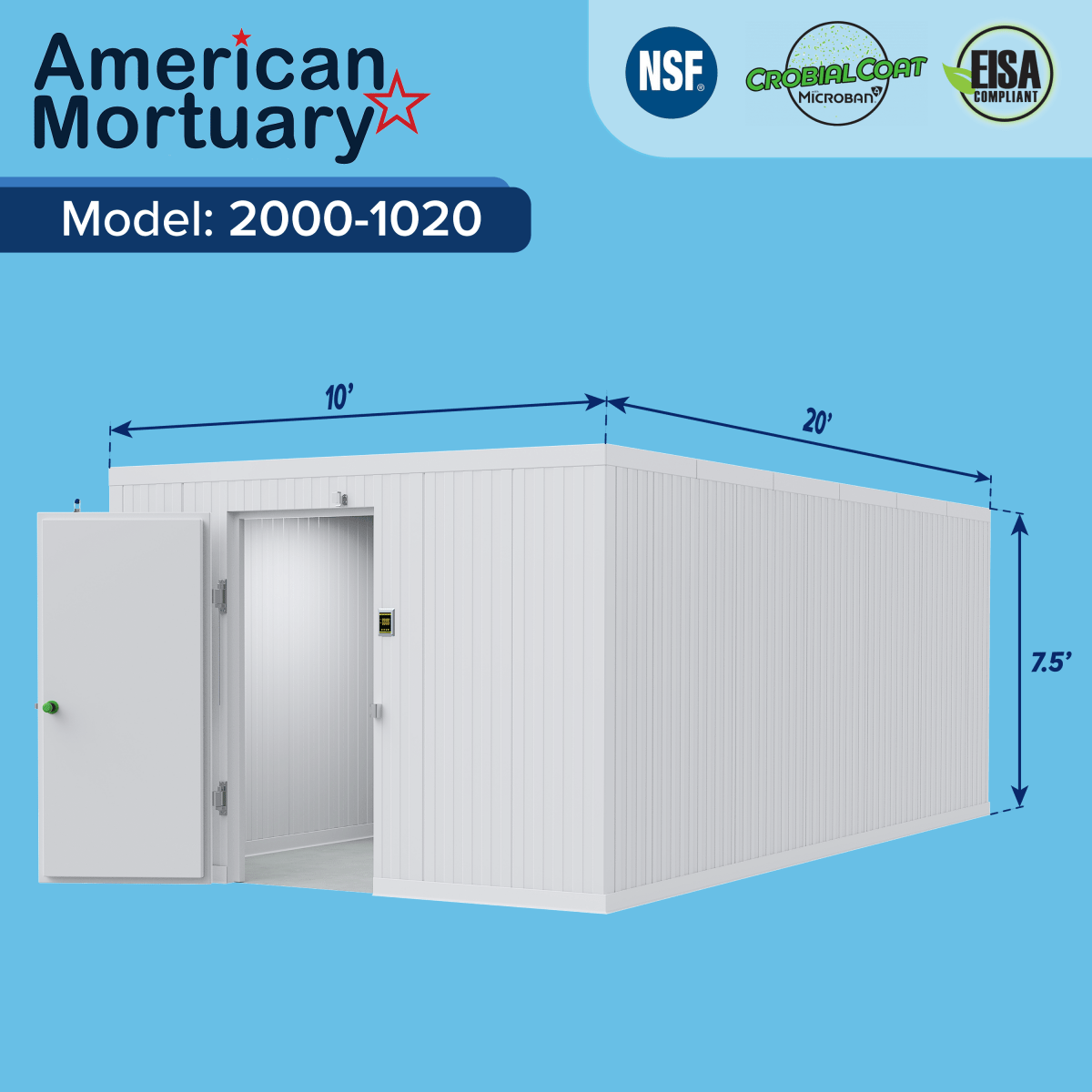

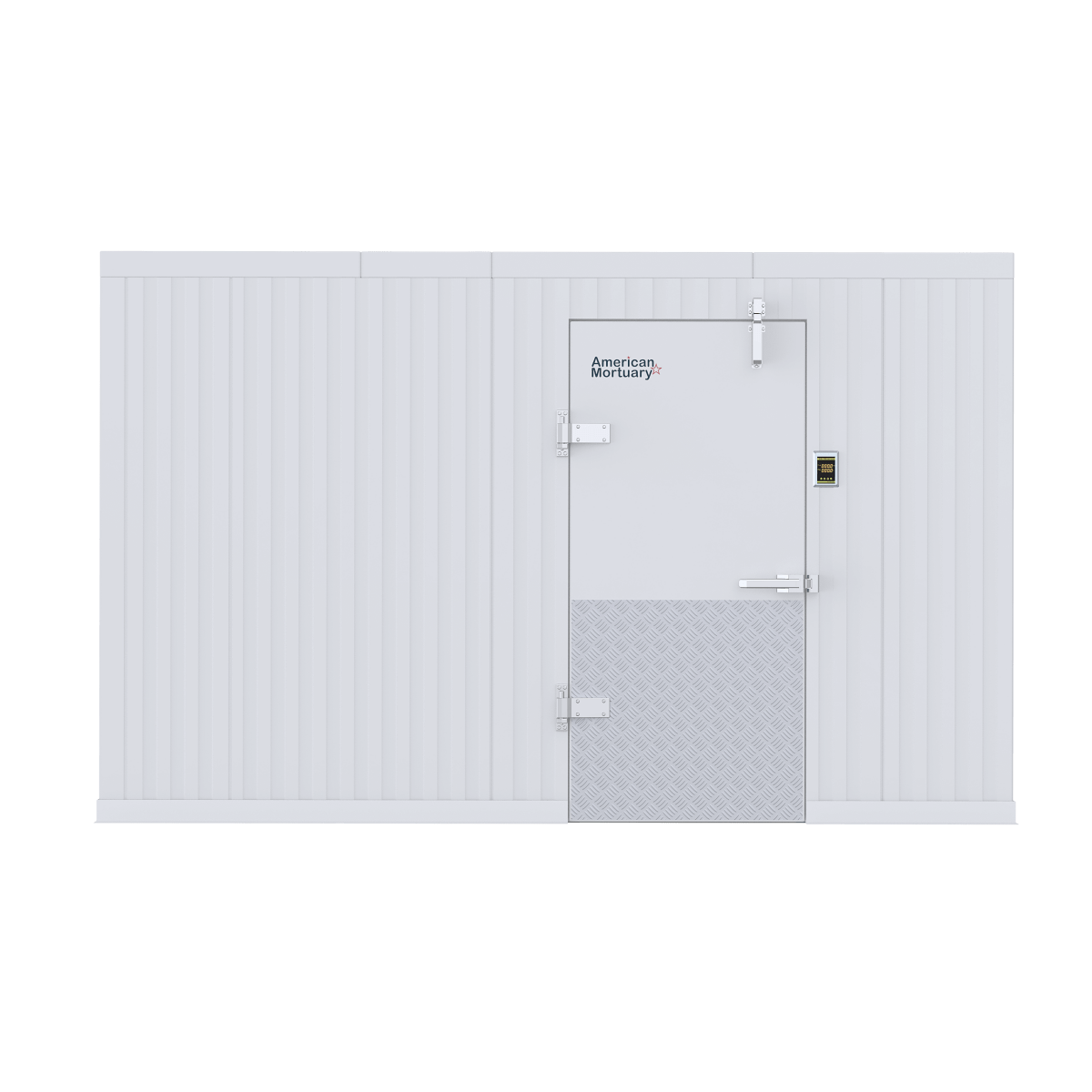

Through our years working with funeral homes across the country, we've seen how financial stability directly impacts service quality. When funeral directors aren't stressed about cash flow, they can focus entirely on what matters most - caring for grieving families. It's similar to how we approach custom mortuary coolers - when the equipment works flawlessly in the background, funeral professionals can concentrate on their calling.

The american funeral finance industry keeps getting better too. New technology makes paperwork faster, competition drives down costs, and innovative companies find better ways to serve both funeral homes and families. Funeral homes that stay informed about these changes and partner with reputable companies will continue thriving.

What excites us most is seeing how reduced stress creates better outcomes for everyone. Families can make informed choices about services without worrying about money. Funeral homes can offer compassionate care without financial constraints. Even suppliers like us at American Mortuary Coolers benefit when our funeral home partners have the financial stability to invest in quality equipment that serves families better.

The synergy between smart financing and quality equipment creates something special - funeral homes that can truly focus on their mission of helping families through difficult times. For funeral homes looking to balance quality with affordability, our guide on budget-friendly goodbyes offers practical insights.

The future looks bright for american funeral finance. As the industry continues innovating and improving, funeral homes and families will have even better options for managing the financial aspects of death care. That means more time and energy can go where it belongs - honoring lives and supporting those who mourn.